November 8, 2023

How to use Budget vs Actual Reports for Tally? Budget vs Actual Reports for Tally to compare planned budgets with actual financial performance. These reports help evaluate performance, track progress, and make informed decisions by highlighting variances in revenue, expenses, or cost centres.

Budgeting is a fundamental tool for both individuals and organizations to manage their finances. It allows for better financial planning, goal-setting, and the ability to track financial progress. One crucial component of effective financial management is the Budget vs. Actual Report, which provides insight into how closely one’s financial reality aligns with their initial budget. In this blog, we will delve into what a Budget vs. Actual Report is, why it’s essential, and how to create and interpret one.

What is a Budget vs Actual Report?

A Budget vs. Actual Report, also known as a variance report, is a financial statement that compares projected or budgeted figures with actual financial performance. It provides a clear snapshot of where an individual or organization stands concerning their financial goals, revenue, and expenses. The report typically covers a specific period, such as a month, quarter, or year.

Why Budget vs Actual Reports Matter?

- Performance Evaluation: Budget vs. Actual Reports are invaluable for evaluating performance. By comparing budgeted figures to actual results, you can identify areas where you exceeded expectations or fell short. This information is crucial for making necessary adjustments and strategic decisions.

- Decision-Making: Understanding the differences between the budget and actual figures helps in decision-making. It enables individuals and businesses to adapt their strategies, allocate resources efficiently, and make informed choices for the future.

- Accountability: Budget vs. Actual Reports create accountability within an organization or for an individual. They help identify responsible parties for variances and encourage transparency in financial matters.

- Goal Tracking: For individuals, these reports can track progress toward personal financial goals, such as saving for a vacation or retirement. For businesses, they monitor progress toward profit targets and growth objectives.

How to Set Up Budget vs Actual Reports in Tally?

- Go to F11->Features and then enable the “Maintain budgets and controls” option (in Tally Prime this is activated by default)

- On the main menu of Tally go to Create budget

- Give the budget a name and then create the budget for each period that you want, e.g. monthly, quarterly or yearly

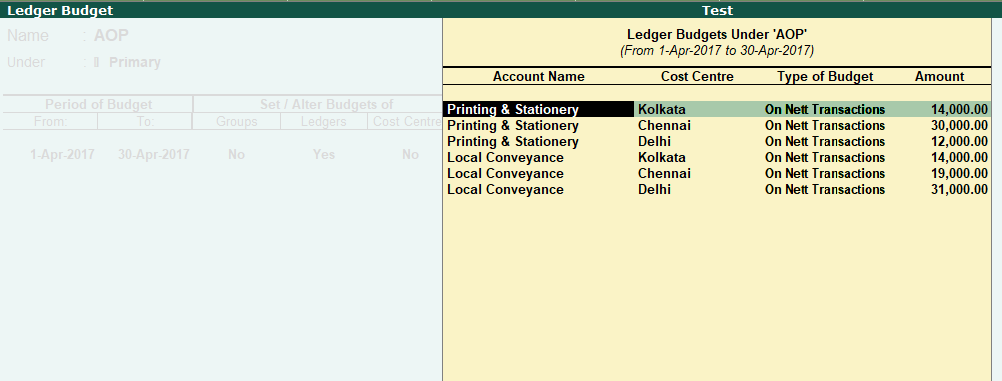

- In Tally, you can define budgets at the group, ledger / cost centre or cost centre level

- Thereafter in most accounting reports, you can add the budget column along with variance by clicking on the new column button

How to Use Budget vs Actual Reports in Reporting Tool like EasyReports?

- EasyReports allows you to upload the budget from Excel in various modes

- Once the budget is uploaded you can straightaway view the various budget vs actual reports in EasyReports with the option to drag and drop fields and see the summation at any level

- You can also highlight the variance with color combinations or KPI icons to display over-budget and near-budget warnings to users

- The budget vs actual report can also be scheduled to cost centre or budget owners to help them track their budget utilization

- For some users it may be important to track budget commitments, i.e. POs issued but expenses not booked against budgets. You can also track these scenarios in EasyReports

A Budget vs. Actual Report is a powerful financial tool that helps individuals and organizations manage their finances effectively. By comparing projected budgets to actual financial performance, it allows for performance evaluation, informed decision-making, and goal tracking. Creating and interpreting these reports can be the key to financial success and continued growth, making it an essential practice for anyone seeking financial stability and prosperity. Visit www.easyreports.in for more.

People Also Ask – FAQs

Q1: What is a Budget vs Actual Report in Tally?

A Budget vs Actual Report compares your planned budget with actual performance, showing variances in revenue, expenses, or cost centres.

Q2: How do I create a Budget vs Actual Report in Tally?

Go to F11 → Features → Create Budget. Define budgets for groups, ledgers, or cost centres, then view them in reports with variance columns.

Q3: Why are Budget vs Actual Reports important?

They help evaluate performance, track progress, identify overspending, and support informed financial decisions.

Q4: Can I use EasyReports with Tally for these reports?

Yes. EasyReports allows budget upload from Excel, visualizes reports, highlights variances, and schedules automated alerts for budget owners.

Q5: What insights can I get from these reports?

You can see over-budget areas, underutilized budgets, financial gaps, and track commitments like pending POs.