October 9, 2023

Introduction

Managing debtors is a crucial aspect of financial management for businesses of all sizes. One valuable tool that can help in this regard is calculating and utilizing the Average Payment Days. This metric provides insight into how long it takes your customers to settle their invoices, helping you make informed decisions to improve cash flow and reduce the risk of bad debts. In this blog, we will explore what Average Payment Days are, why they matter, and how you can use them effectively to manage your debtors.

What Are Average Payment Days?

Average Payment Days also known as Average Collection Period, is a financial metric that measures the average number of days it takes for a company to collect payment from its customers after making a sale. It provides valuable information about the efficiency of your accounts receivable management.

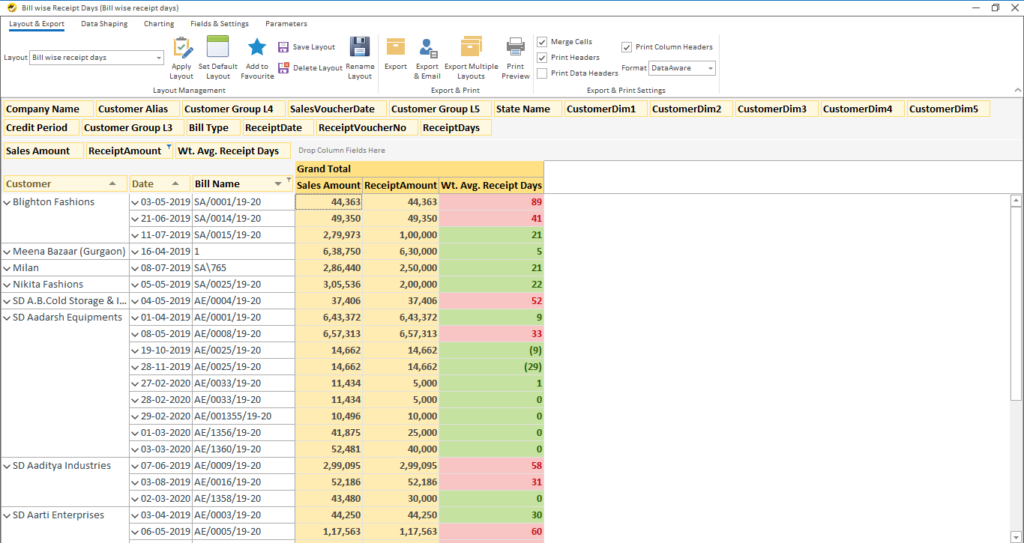

You can calculate this either using a formula or by using the actual no of payment days for each invoice. In the per invoice method it is important to factor in multiple payments for an invoice to arrive at the weighted average payment days for that invoice and then summation of the average payment days per invoice to get the weighted average payment days for the customer as a whole.

Average Payment Days = (Accounts Receivable / Total Credit Sales) * Number of Days in the Period

For example, if your accounts receivable is Rs.5,00,000, your total credit sales over the past month were Rs.10,00,000, and the month had 30 days, your Average Payment Days would be:

(5,00,000 / 10,00,000) * 30 = 15 days

Why Do Average Payment Days Matter?

Understanding Average Payment Days is essential for several reasons:

Cash Flow Management :

Knowing how long it takes on average to collect payment allows you to better forecast your cash flow. It helps you plan for incoming funds and ensures you have enough working capital to cover expenses.

Identifying Problematic Accounts :

By monitoring this metric, you can identify customers who consistently delay payments, allowing you to take appropriate action, such as implementing stricter credit terms or collection efforts.

Reducing Bad Debt Risk :

Keeping tabs on this can help minimize the risk of bad debts. If you notice a prolonged increase in this metric, it could signal potential financial distress for your customers, allowing you to address the issue proactively.

Improving Efficiency :

Tracking this method can help you evaluate the effectiveness of your accounts receivable management processes. You can identify bottlenecks or inefficiencies and make necessary adjustments to speed up collections.

Using Average Payment Days for Managing Debtors

Now that you understand the importance of Average Payment Days, let’s delve into how you can use this metric effectively to manage your debtors:

Set Clear Credit Terms :

Establish clear and concise credit terms for your customers. Make sure they understand when payments are due and any penalties for late payments.

Regularly Monitor and Analyze :

Keep a close eye on this method by calculating it regularly, such as monthly or quarterly. Analyze trends and identify any significant fluctuations.

Segment Your Customers :

Categorize your customers based on their payment behavior. This segmentation can help you tailor your collection strategies to different customer groups.

Streamline Invoicing and Collection Processes :

Ensure that your invoicing and collection processes are as efficient as possible. This includes sending invoices promptly, providing multiple payment options, and automating reminders for overdue payments.

Offer Incentives for Early Payments :

Consider offering discounts or incentives for customers who pay their invoices early. This can motivate them to settle their bills sooner.

Review and Adjust Credit Limits :

Regularly review and adjust the credit limits for your customers based on their payment history and creditworthiness. This can help you minimize the risk of extending credit to high-risk customers.

Conclusion

Average Payment Days are a valuable tool for managing debtors and ensuring the financial health of your business. By consistently monitoring this metric and taking proactive steps to improve your accounts receivable management processes, you can reduce the risk of bad debts, enhance cash flow, and build stronger customer relationships. Effective debtor management not only improves your bottom line but also helps your business thrive in the long run.