October 18, 2023

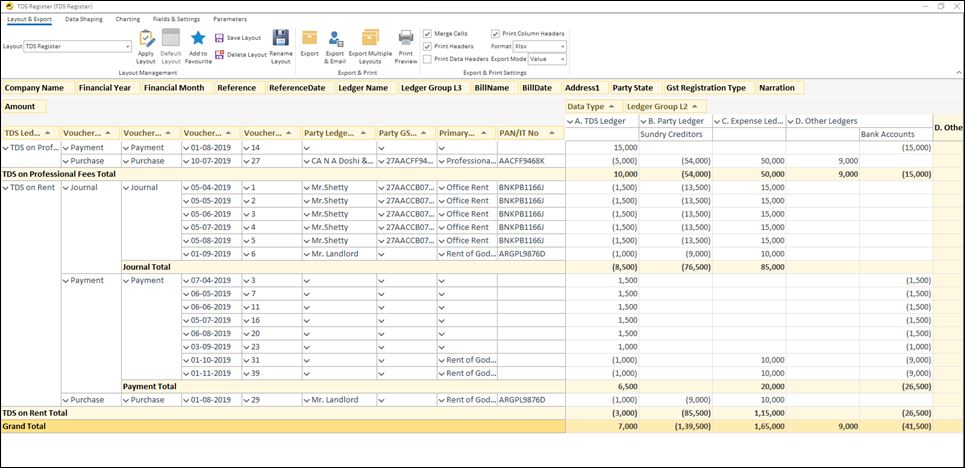

How to Use the TDS Register Report in Tally? The TDS Register Report in Tally provides a comprehensive overview of all TDS (Tax Deducted at Source) deductions made during a specific period. It displays key details such as party-wise and transaction-wise TDS deductions, expense ledger debits with corresponding credits, and any adjustments or payments made in the TDS ledger. This report is especially useful for accountants and auditors, helping them quickly verify TDS deductions and ensure full compliance with statutory tax requirements.

What is TDS?

The government introduced the TDS (Tax Deducted at Source) system to collect tax at the source from individuals or entities making payments. In India, there are various sections (nature of transactions) under which TDS is deducted by the payer and the rates also vary according to the nature of the transaction and in certain cases based on the nature of the payee. So, let’s dive into using the TDS Register Report.

TDS in Tally

In Tally, it is possible to setup TDS tracking. The following are the steps to setup TDS in Tally:

- To setup TDS you have to first enable it through F11 -> Features

- Setup the deduction ledgers through the ledger screen by creating ledgers under the Duties and Taxes group

- In Expense Ledgers then you can tag the TDS applicability through the “Is TDS Applicable” setting and also select the Nature of Payment from the List of Nature of Payments

- In party master, you will have to tag the TDS applicability and also specify the nature of the party since the rates vary in some sections according to the party type

- You can also setup the nil or lower deduction certificate details in the party master if the same is applicable

- Now when the setup is complete you can pass transactions and the TDS should automatically be applied

Reporting on TDS

If you have maintained the setup in Tally and pass transactions according to the guidelines then you should be able to get the TDS register from Tally itself including return formats.

However, for a lot of users of Tally, there is difficulty in maintaining the setup and passing transactions with the required rules. In such cases, the TDS register report in EasyReports would help you to report on the TDS deductions.

The TDS register provides a columnar view of the bookings done in the TDS ledger. In one view itself, you can see all the transactions passed in the TDS ledger and see the bookings party-wise with the details of the debit to the expense account and the party or bank credits. If there are any adjustments or payments in the TDS ledger the same would also show up.

This report would be extremely helpful to accountants and auditors as well since it would save a lot of time with ledger scrutiny for statutory and tax audit purposes. Combined with the “Expense Register” report from EasyReports one can easily get data for tracking TDS.

FAQ Section (People May Ask)

1. What is the purpose of TDS?

The main purpose of TDS is to collect tax at the very source of income, reducing the chances of tax evasion and ensuring a steady inflow of revenue for the government.

2. How do I enable TDS in Tally?

To enable TDS in Tally, go to F11 → Statutory Features → Enable TDS, and then set up:

- Deduction ledgers under “Duties and Taxes”

- Expense ledgers with “Is TDS Applicable” set to Yes

- Party masters with TDS applicability and party type

3. What details are shown in the TDS Register Report?

The TDS Register Report displays:

- All TDS-related transactions

- Party-wise booking details

- Expense and TDS ledger adjustments

- Payments or nil/lower deduction entries

4. What if my TDS setup in Tally is incorrect?

If your TDS setup in Tally isn’t maintained properly, you can use the TDS Register Report in EasyReports, which automatically compiles data from Tally and provides a clear, accurate TDS summary.

5. Who benefits from using the TDS Register Report?

The report is especially useful for accountants, auditors, and tax professionals who need to verify TDS compliance efficiently without manually checking each ledger entry.