August 14, 2024

Preparing financial statements is a critical task for any business. It provides insights into your company’s financial health, helps make informed decisions, and ensures compliance with accounting standards. If you use Tally.ERP9 or Tally Prime, the most efficient way to start is by exporting the trial balance. The trial balance lists all ledger accounts with their debit or credit balances and serves as the foundation for financial statements. In this guide, we’ll show you how to prepare financial statements from trial balance in Tally step by step.

Step 1: Export the Trial Balance from Tally

Start by exporting the trial balance from Tally:

- Log in to Tally: Go to the Main Menu → Display → Display More Reports → Trial Balance.

- Select the Reporting Period: Choose the fiscal period for which you want to prepare the trial balance.

- Export the Report: Export the trial balance as an Excel file for further processing.

Step 2: Verify the Trial Balance

Ensuring the trial balance is accurate is essential before preparing financial statements.

- Check Completeness: Confirm that closing entries, provisions, and closing stock are reflected.

- Debits Equal Credits: Verify that total debit balances match total credit balances. Any mismatch needs correction.

- Review Anomalies: Look for unusual account balances or transactions that may indicate errors.

Step 3: Make Adjusting Entries (If Needed)

If errors or discrepancies appear, make adjusting journal entries in Tally:

- Accruals and Deferrals: Adjust for accrued expenses, revenues, or prepaid items.

- Depreciation: Record depreciation for assets not yet accounted for.

- Error Corrections: Fix any mistakes found during verification.

After adjustments, rerun the trial balance to ensure all accounts are accurate.

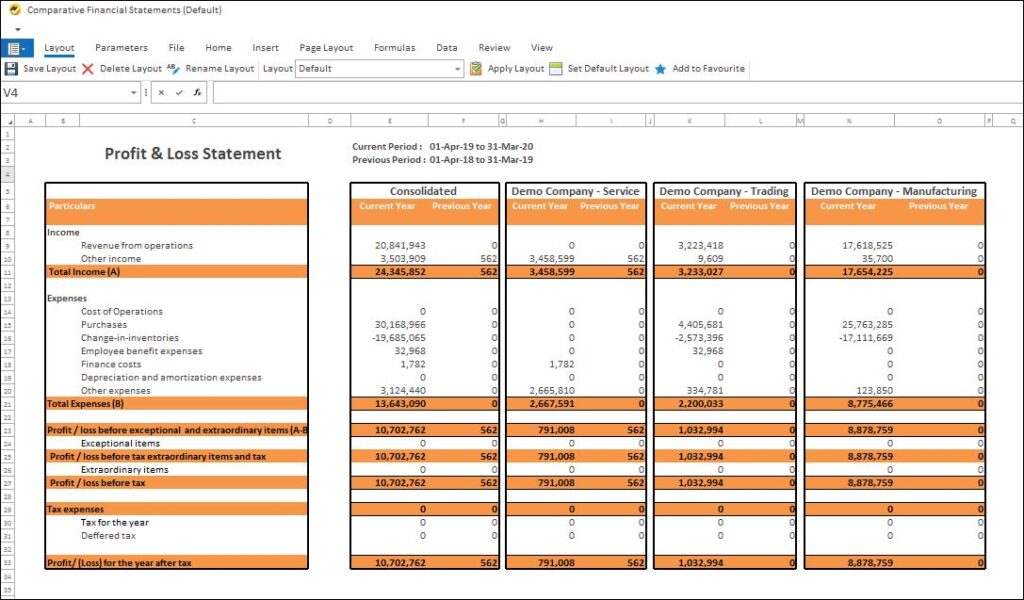

Step 4: Prepare the Income Statement

The income statement summarizes revenues and expenses for a specific period.

- Identify Revenue Accounts from the trial balance.

- Identify Expense Accounts to calculate total expenses.

- Calculate Gross Profit: Subtract cost of goods sold (COGS) from total revenue.

- Calculate Net Income: Subtract operating expenses and taxes from gross profit.

- Format the Income Statement: Present revenues, expenses, and net income clearly.

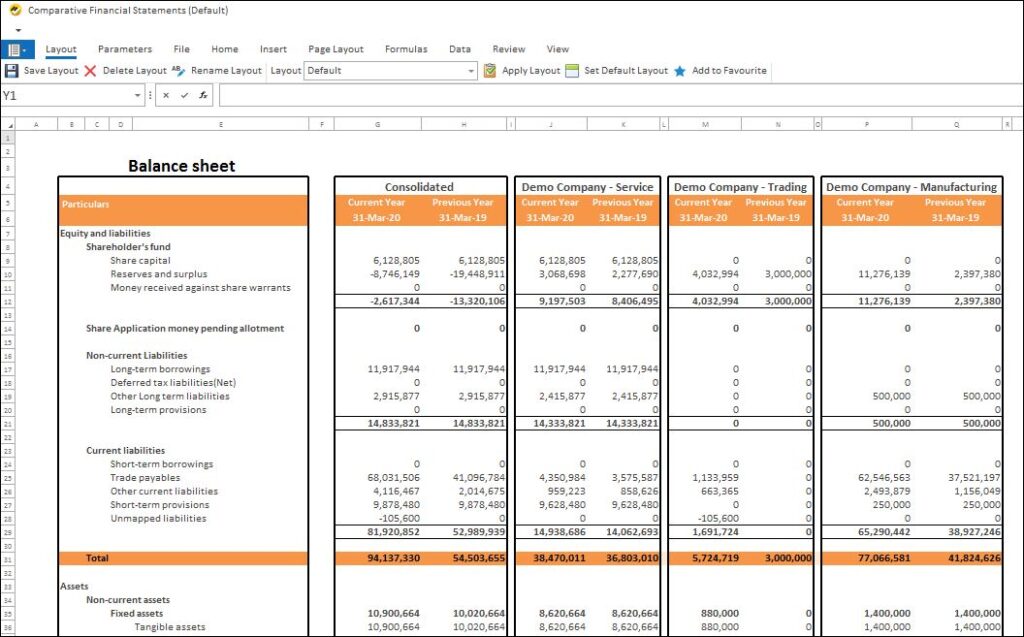

Step 5: Prepare the Balance Sheet

The balance sheet provides a snapshot of your company’s financial position.

- List Asset Accounts: Cash, accounts receivable, inventory, and property.

- List Liability Accounts: Accounts payable, loans, and other obligations.

- Calculate Equity: Total assets minus total liabilities.

- Ensure Balance: Verify that assets equal liabilities plus equity.

Step 6: Prepare the Cash Flow Statement

The cash flow statement shows cash movements in your business, divided into:

- Operating Activities: Adjust net income for working capital changes and non-cash items.

- Investing Activities: Record cash spent or received from asset purchases or sales.

- Financing Activities: Include borrowing, debt repayments, stock issuance, or dividend payments.

Ensure cash flow balances match the cash balances in the balance sheet.

Step 7: Review and Finalize Financial Statements

Before finalizing:

- Cross-check with the Trial Balance: Ensure all figures match.

- Verify Consistency: Confirm all statements are consistent.

- Consult Stakeholders: Share drafts with management or auditors for feedback.

Automate Financial Statements with EasyReports BI

While Tally is excellent for accounting, EasyReports BI can automate financial statements preparation, including:

- Automatic Balance Sheet, Profit & Loss, and Cash Flow statements

- Consolidation and currency conversion for multi-company setups

- Custom adjustments and report customization

- Faster, error-free reporting for management decisions

Visit www.easyreports.in to book a personalized demo and explore how EasyReports BI can streamline your financial reporting.

EasyReports Comparative Financial Statements of Balance Sheet (Screenshot)

EasyReports Comparative Financial Statements of Profit & Loss (Screenshot)

Disclaimer: This blog article is for educational purposes only. Tally is a product of Tally Solutions Pvt. Ltd. and we do not claim any affiliation.