August 14, 2024

Preparing financial statements is a crucial task for any business, as it provides insights into the company’s financial health and performance. If you’re using Tally.ERP9 or Tally Prime, one of the most efficient ways to start this process is by exporting the trial balance. The trial balance acts as a foundational report that lists all ledger accounts with their respective debit or credit balances. This guide will walk you through the steps to prepare financial statements from a trial balance export in Tally.

Step 1: Export the Trial Balance from Tally

The first step is to export the trial balance from Tally:

- Log in to Tally: Access the Main Menu and Click Display or Display More Reports -> Trial Balance.

- Select the Reporting Period: Choose the fiscal period for which you want to prepare the trial balance.

- Export the Report: Export the trial balance as an Excel file.

Step 2: Verify the Trial Balance

Once you’ve exported the trial balance, it’s crucial to verify its accuracy. This involves:

- Checking for Completeness: Run a check to ensure that closing entries are reflected, e.g. provisions, closing stock, etc.

- Ensuring Debits Equal Credits: The total of debit balances should equal the total of credit balances. If not, you’ll need to identify and correct the discrepancies before proceeding. This will normally be equal but in case of any errors, it may be a mismatch.

- Reviewing for Any Anomalies: Look for unusual account balances or transactions that may indicate errors.

Step 3: Adjust Entries (If Necessary)

If there are any discrepancies or errors found during the verification step, you’ll need to make adjusting journal entries. These adjustments might include:

- Accruals and Deferrals: Adjust for any accrued expenses, revenues, or prepaid items that need to be recognized.

- Depreciation: Record depreciation expenses that have not yet been accounted for.

- Error Corrections: Correct any errors identified during the trial balance verification.

Once adjustments are made, rerun the trial balance to ensure that debits still equal credits and that all accounts are accurate.

Step 4: Prepare the Income Statement

The income statement, also known as the profit and loss statement, summarizes the company’s revenues and expenses over a specific period. Here’s how to prepare it:

- Identify Revenue Accounts: Locate all accounts related to revenue in the trial balance.

- Identify Expense Accounts: Identify all expense accounts.

- Calculate Gross Profit: Subtract the cost of goods sold (COGS) from total revenue.

- Calculate Net Income: Subtract operating expenses and taxes from the gross profit to determine the net income.

Arrange the information in a standard income statement format, showing revenues, expenses, and net income.

Step 5: Prepare the Balance Sheet

The balance sheet provides a snapshot of the company’s financial position at a specific point in time. It consists of assets, liabilities, and equity. To prepare the balance sheet:

- Identify Asset Accounts: List all asset accounts, such as cash, accounts receivable, inventory, and property.

- Identify Liability Accounts: List all liabilities, including accounts payable, loans, and other obligations.

- Calculate Equity: Equity is typically the difference between total assets and total liabilities.

- Ensure Balance: The total of assets should equal the sum of liabilities and equity.

Structure the information into a standard balance sheet format, showing the assets on one side and liabilities and equity on the other.

Step 6: Prepare the Cash Flow Statement

The cash flow statement shows how cash is moving in and out of the business. It’s divided into three sections: operating activities, investing activities, and financing activities.

- Operating Activities: Start with net income and adjust for changes in working capital and non-cash items like depreciation.

- Investing Activities: Include cash spent or received from buying or selling assets.

- Financing Activities: Record cash flows from borrowing, repaying debt, issuing stock, or paying dividends.

The cash flow statement should reconcile with the cash balances shown in the balance sheet.

Step 7: Review and Finalize the Financial Statements

Before finalizing the financial statements:

- Cross-check with the Trial Balance: Ensure all figures match those in the trial balance.

- Verify Consistency: Check that all financial statements are consistent with one another.

- Consult with Stakeholders: Share the draft statements with relevant stakeholders, such as management or external auditors, for review.

Conclusion

To prepare financial statements from a trial balance export from Tally is a systematic process that requires attention to detail. By following these steps—exporting the trial balance, verifying data, making necessary adjustments, and compiling the financial statements—you can ensure that your financial reporting is accurate and reliable.

If you want to automate your financial statement preparation you can consider EasyReports Financial Statement module wherein it can automatically prepare the Balance Sheet, Profit & Loss and Cash Flow Statements along with consolidation, currency conversion and adjustments as needed.

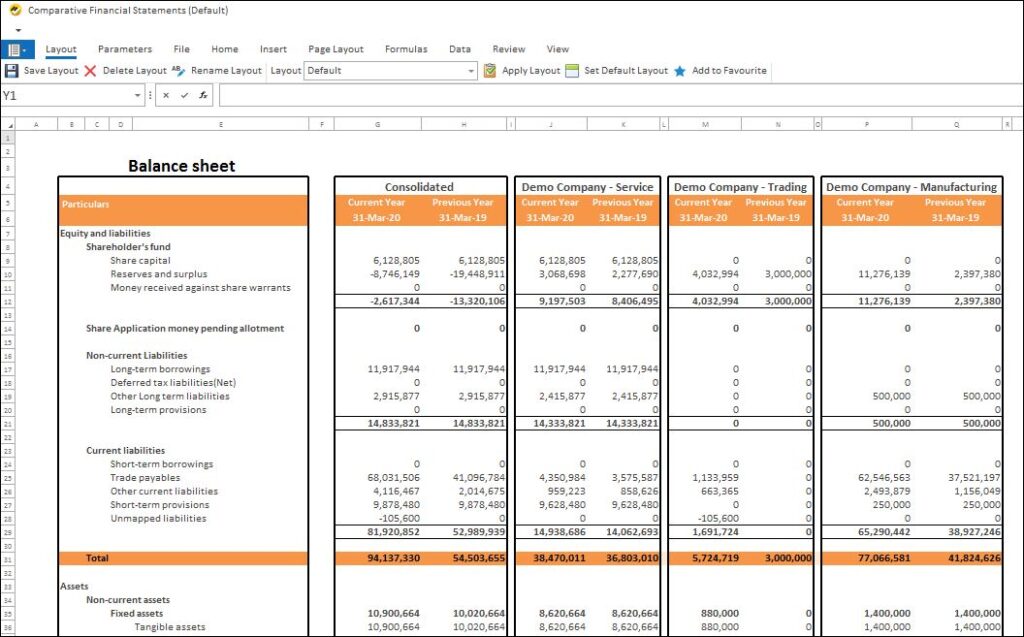

EasyReports Comparative Financial Statements of Balance Sheet (Screenshot)

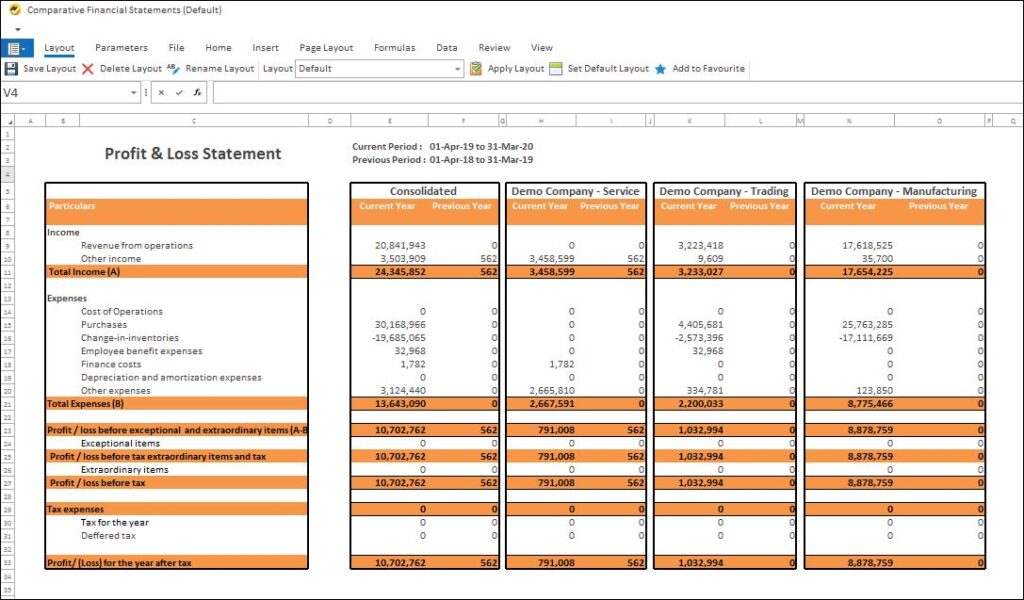

EasyReports Comparative Financial Statements of Profit & Loss (Screenshot)