August 14, 2025

How to Monitor Project Profitability Using Reporting Tool? To monitor project profitability using a reporting tool, integrate your ERP data (like Tally or SAP B1) and generate real-time reports showing project revenue, expenses and profit margins. A reporting tool automates data tracking, compares actuals vs. budgets and visualizes performance through reports & dashboards helping businesses identify profitable projects and control costs effectively.

1. What is Project Profitability?

Project profitability shows how much money a project earns after subtracting all its costs. It helps you see whether the project is worth your time and resources. In simple terms, if your project earns more than it spends, it’s profitable. If not, you need to take action to improve it.

2. Why Monitoring Project Profitability Benefits Your Business

Regularly checking project profitability gives you:

- Better financial control – You know where money is going and why

- Improved cost efficiency – Reduce waste and unnecessary expenses

- Higher success rate – Focus on projects that give maximum returns

3. Use a Reporting Tool for Project Profitability

A reporting tool like EasyReports automates this process. With EasyReports, you can:

- Pull data directly from Tally or other ERP & data sources

- Generate detailed profit and cost reports in seconds

- Compare budgets with actual performance

- Perform cost allocations of common or corporate costs across projects

- Assign salary costs across projects based on timesheets and allocation ratios

4. Key Reports of EasyReports for Monitoring Project Profitability

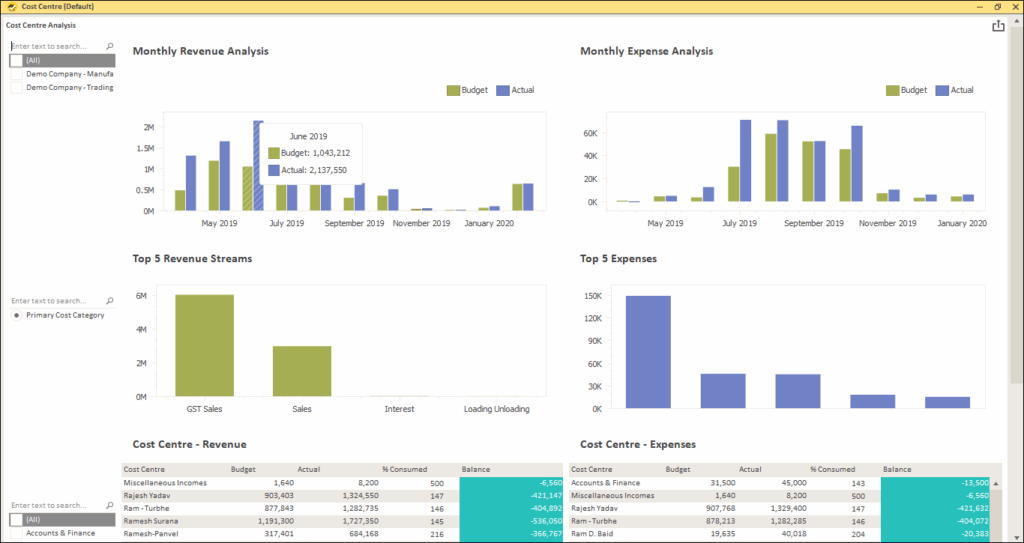

4.1) Monitor Key Metrics in the Cost Centre Dashboard

This Dashboard gives you a complete visual snapshot of project performance. The breakdown given below:

- Monthly Revenue and Expense Analysis – Compare budgeted vs actual figures month by month using clear bar charts.

- Top 5 Revenue Streams – Identify which income sources, like GST Sales or other categories, bring the most revenue.

- Top 5 Expenses – Spot the largest cost drivers instantly, helping you take action on overspending areas.

- Cost Centre-wise Revenue and Expenses – Check the budget, actuals, % consumed and balance for each cost centre at a glance.

This dashboard is perfect for managers who want quick, data-driven insights without digging into multiple reports.

4.2) Profit & Loss – Cost Centre Report

This report gives you a month-by-month view of revenue, expenses and profit for each project or cost centre. It helps:

- Side-by-side monthly figures to compare performance over time.

- Amount Percent Variation to quickly spot increases or decreases in income and expenses.

- Helping you see which areas contribute most to profit or loss.

With this report, you can easily identify trends, monitor variances, and take action to improve profitability before small issues become big problems.

4.3) Track Every Transaction with Cost Centre Transactions

This report gives a complete summary of all financial entries linked to a specific project or cost centre. It helps:

- Voucher-level details such as date, narration, voucher type and reference for each transaction.

- A clear split of accounts like GST Sales or Discount Given, so you know exactly where money is coming from or going to.

- Helping you track individual contributions and expenses.

By regularly reviewing this report, you can ensure every transaction is correctly recorded, spot any wrongly assigned entries and maintain accurate project accounts.

4.4) Track Cost Allocations

Cost allocations can be done based on defined rules as needed by the organization:

- Cost Allocation Report – Track cost allocations from a common pool to projects

- Salary Cost Allocations Report – Track salary cost allocation across projects

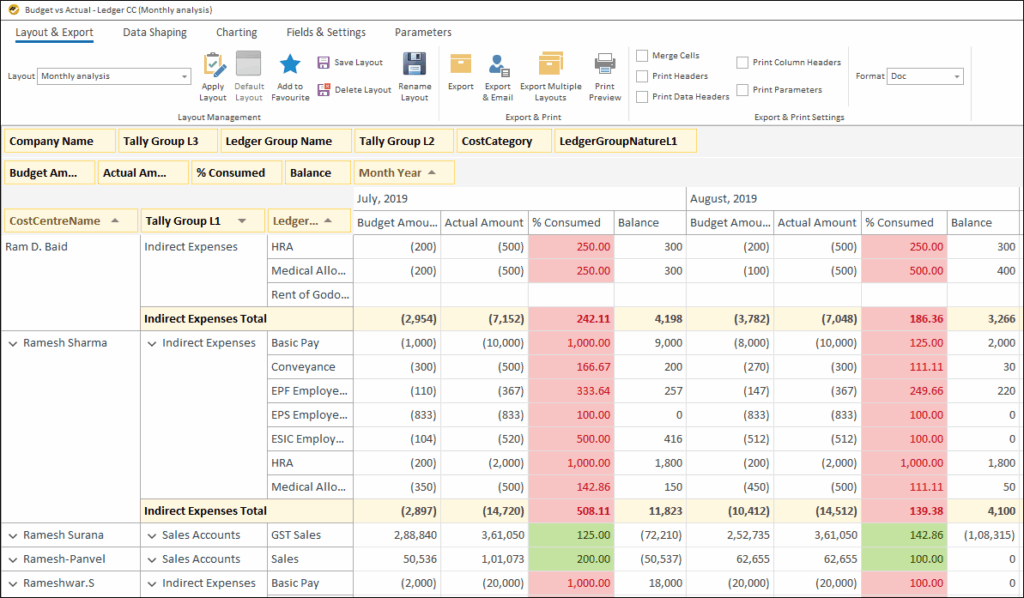

4.5) Compare Budgets with Budget vs Actual – Ledger CC

This report helps to see if your project is staying within its planned budget. It tells:

- Budget Amount vs Actual Amount for each ledger, cost centre or team member.

- % Consumed highlighted in colour — green for on-track spending and red for overspending, so you can spot issues instantly.

- Balance figures showing how much budget is left or exceeded.

- A detailed breakdown for both income (like GST Sales) and expenses (like salaries, allowances, and operational costs).

By checking this report regularly, you can quickly identify cost overruns, adjust spending plans, and keep your projects profitable before small variances turn into major losses.

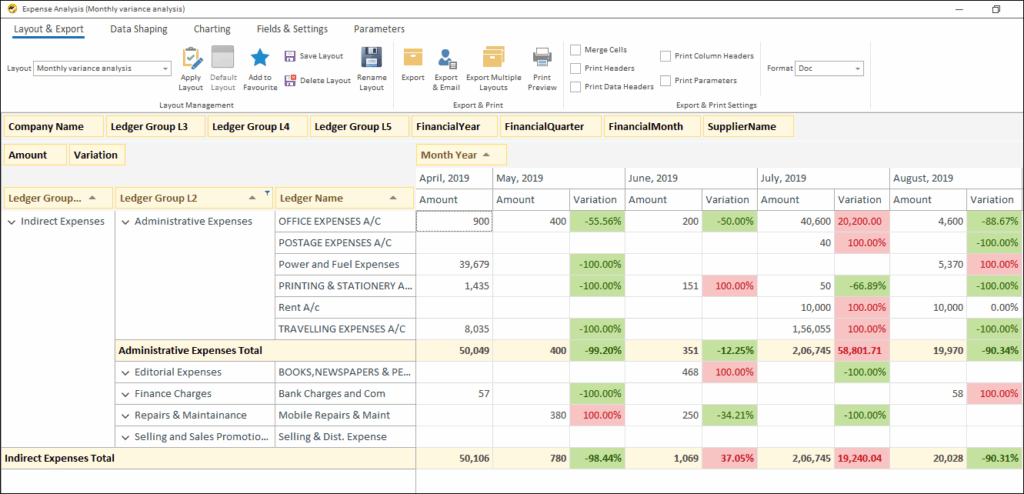

4.6) Review Costs with Expense Analysis

This report gives a clear breakdown of your spending across different expense categories. It

- Detailed Expense Groups

Expense groups like: Staff salaries & benefits, utilities, professional services, warehousing & logistics, office supplies & miscellaneous expenses, internet costs, etc.

These help track all major cost areas in one place and spot unusual spending patterns.

- Monthly amounts with percentage variations to instantly spot increases or decreases in spending.

By monitoring this report regularly, you can quickly identify overspending trends, control indirect costs, and protect your project’s bottom line.

5. How to Get Start with EasyReports?

To track project profitability using reporting tool like EasyReports, follow the process below:

- Install EasyReports: Set up the reporting tool

- Integrate with multiple data sources: Integrate with ERPs, databases and other data sources

- Run initial reports: Generate standard reports to understand your stock position

- Set up regular schedules: Create automatic report generation schedules

Monitoring project profitability is not just about tracking numbers, it’s about making smarter decisions. With EasyReports, you get detailed reports and dashboards that make it simple to see where your projects are making money and where they are losing it.

By regularly using reports like Profit & Loss – Cost Centre, Cost Centre Transactions, and Budget vs Actual Ledger CC, you can stay in control and ensure every project delivers maximum profit. Get the demo now!

Frequently Asked Questions (FAQs)

1) What is project profitability?

Project profitability shows how much money a project earns after subtracting all its costs. It helps businesses understand whether a project is profitable and if resources are being used efficiently.

2) Why is monitoring project profitability important?

Monitoring project profitability allows you to control costs, improve financial efficiency, focus on high-return projects, and make informed business decisions.

3) How can a reporting tool help monitor project profitability?

A reporting tool like EasyReports automates data collection from Tally or other ERPs, generates detailed reports, compares budgets with actuals, allocates costs, and provides dashboards for easy tracking.

4) What are the key reports for tracking project profitability in EasyReports?

Key reports include:

- Cost Centre Dashboard (Revenue & Expenses)

- Profit & Loss – Cost Centre Report

- Cost Centre Transactions

- Budget vs Actual – Ledger CC

- Expense Analysis

5) How do I get started with EasyReports for monitoring project profitability?

You can get started by installing EasyReports, integrating it with your ERPs or data sources, generating initial reports, and setting up regular automated report schedules.