December 16, 2019

GST has replaced many Indirect Taxes in India. The Act was passed in the Parliament on 29th March 2017. This is a comprehensive tax put into practice with effect from 1st July 2017. With the roll-out of GST, it is very important for the business houses to keep themselves abreast with the practices and policies of GST .

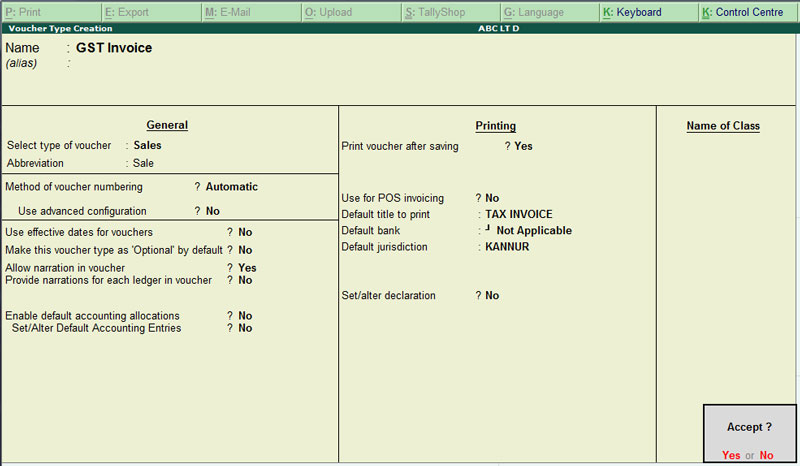

Here we have the steps to create Sales Invoice in Tally.ERP 9 for GST;

Step 1: Go to the Gateway of Tally (GOT)

Step 2: Click on Accounting Vouchers

Step 3: Select F8: Sales. (For invoice number, write the serial number of the bill)

Step 4: Under Party A/C name column, select the party ledger or the cash ledger.

Step 5: Select the relevant sales ledger (If it is local sale ,then select sales ledger for local taxable sales and if it is interstate sale, then select the sales ledger for interstate sales)

Step 6: Select the required items, and specify the quantities and rates.

Step 7: Select the central and state tax ledger, in case of local sales.

Step 8: Depending on the user’s requirements, user can include additional details in their invoice by clicking F12: Configure such as buyer’s order no,delivery note no etc.

Step 9: You can view the tax details by clicking A: Tax Analysis.

Step 10: Click F1: To view the detailed tax break-up.

Step 11: Press Alt+P to print the invoice in the required format, in sales invoice.

Step 12: Press Alt+P and then Alt+C to select multiple number of copies.