Streamline financial reporting, budgeting and fund flow management with EasyReports.

Gain real-time insights into cash flow, credit utilization and working capital performance.

Financial Statements

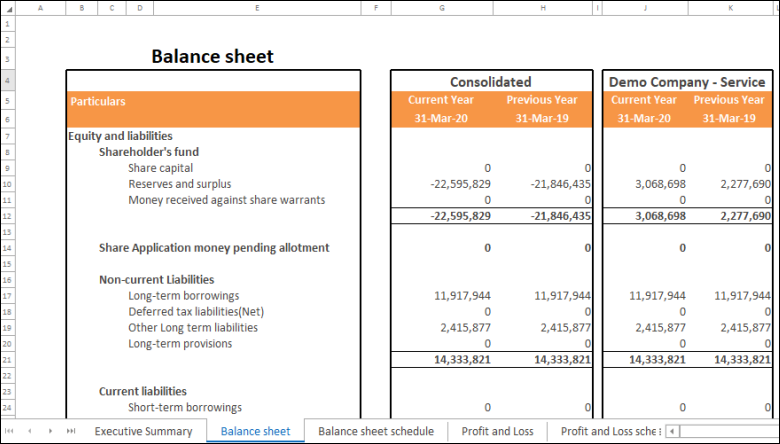

Balance Sheet

- Formatted Balance Sheet

- Entity wise + consolidated at group level

- Intercompany adjustments based on ledgers in Tally

- Comparison with previous period

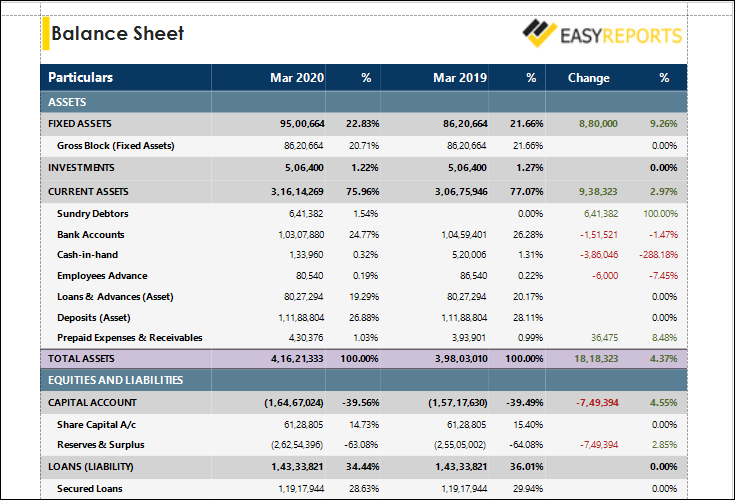

Balance Sheet PDF format

- Formatted Balance Sheet in a PDF format

- Entity wise + consolidated at group level

- Intercompany adjustments based on ledgers in Tally

- Comparison with previous period

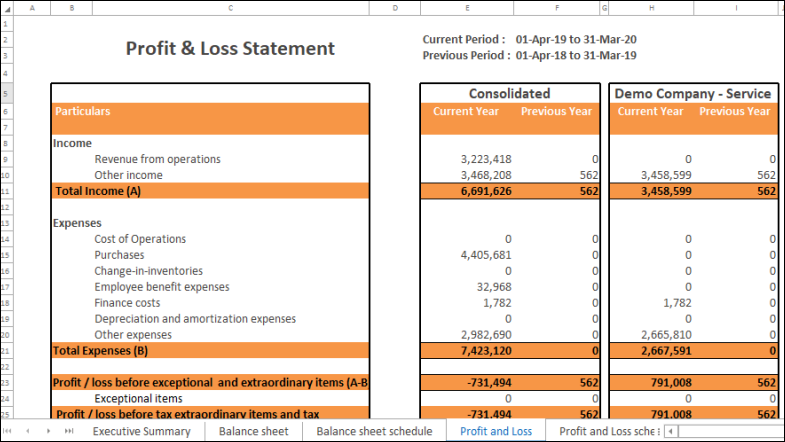

Profit & Loss Statement

- Formatted P&L Statement

- Entity-wise and group-wise consolidated

- Intercompany adjustments

- Comparison with previous period

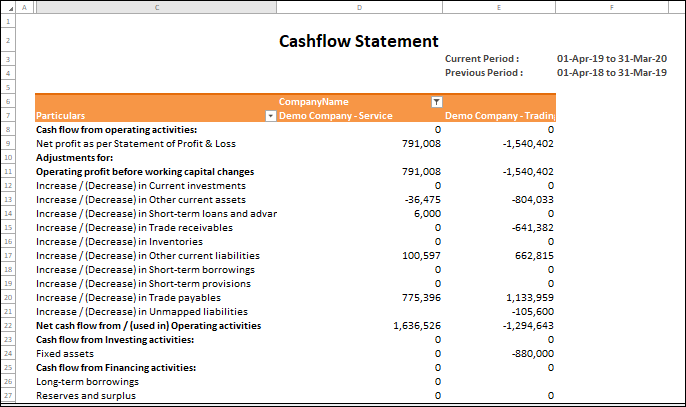

Cash Flow Statement

- Track flow of funds within the organization

- Understand where profits have gone

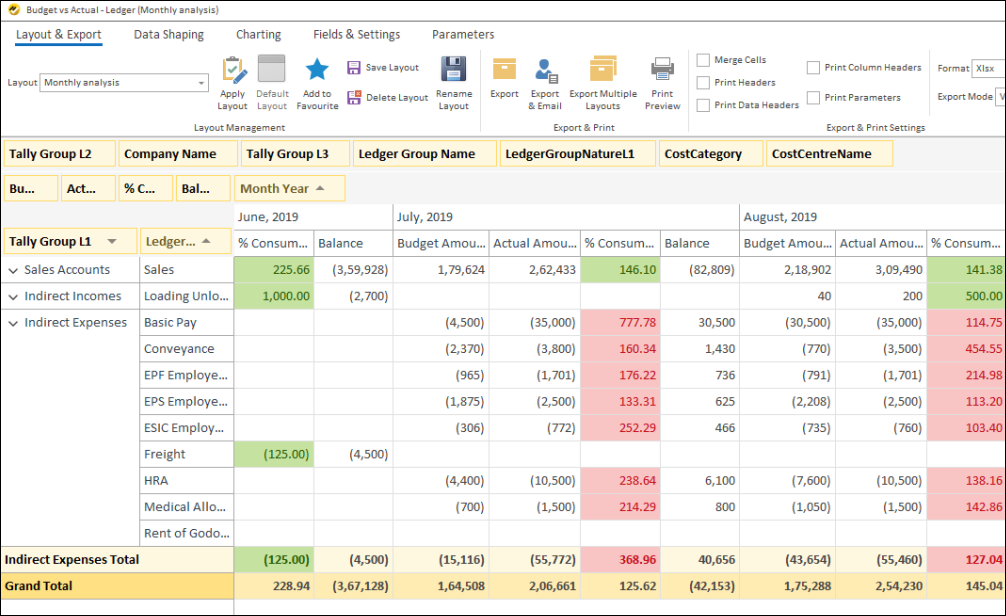

Budget Analysis

Budget vs Actual

- Helps Company To:

- Compare actuals with budgets

- Track expenses that exceeded budgets

- Track revenues below targets

Other Options Available:

- Filter by company

- Summarize at group level

- View quarterly or yearly

Additional Data Management – Budget vs Actual

- Upload budget data by year, quarter, or month

- Maintain budgets at ledger or cost-centre level

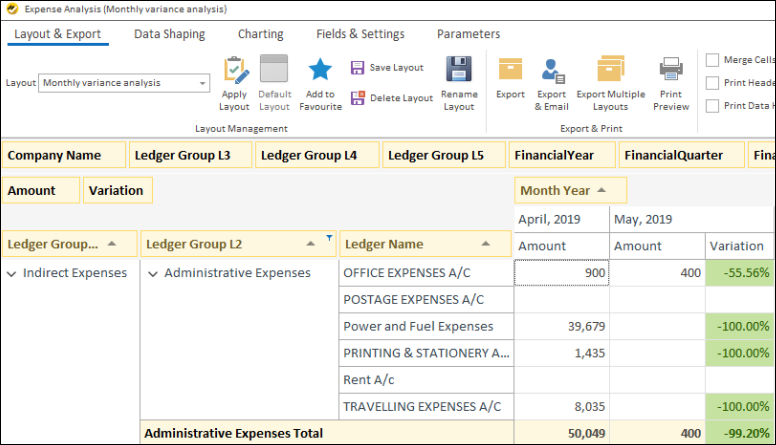

Expense Analysis

Helps Company To:

- Track expenses

- Analyze variation from previous month

- Highlight variations exceeding a set threshold

Other Options Available:

- Filter by company

- Summarize at group level

- View quarterly or yearly

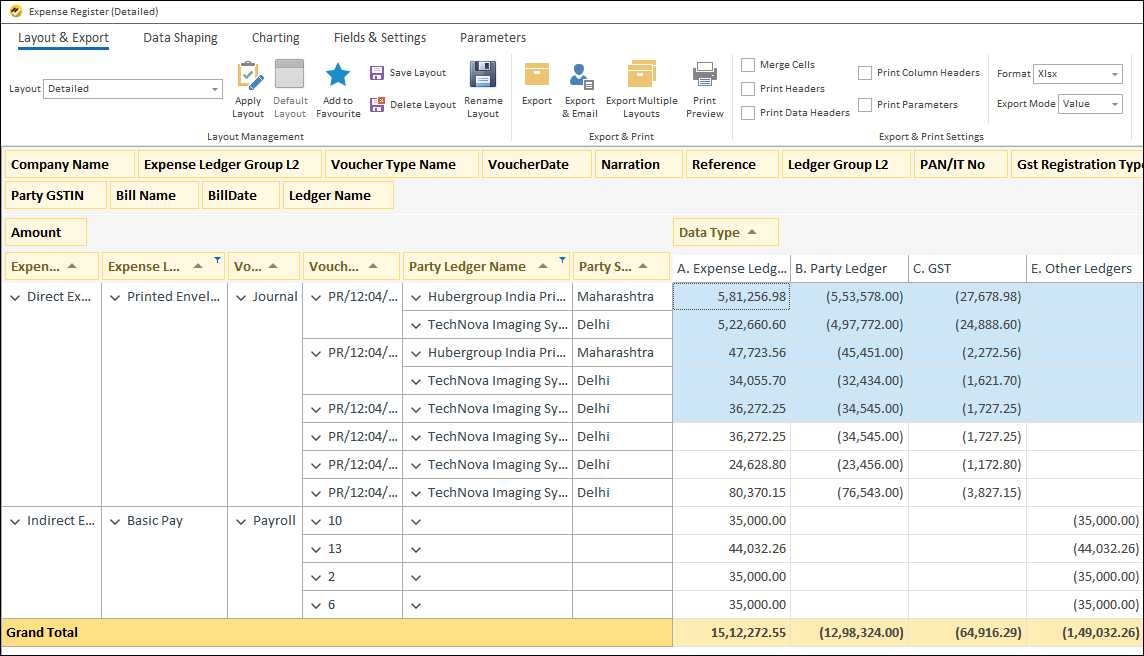

Expense Register

Helps Company To:

- Track all expense-related entries

- Get specific ledger details

- View party, TDS, and GST ledger data for reconciliation

Other Options Available:

- Filter by company

- Summarize at group level

- View by date range

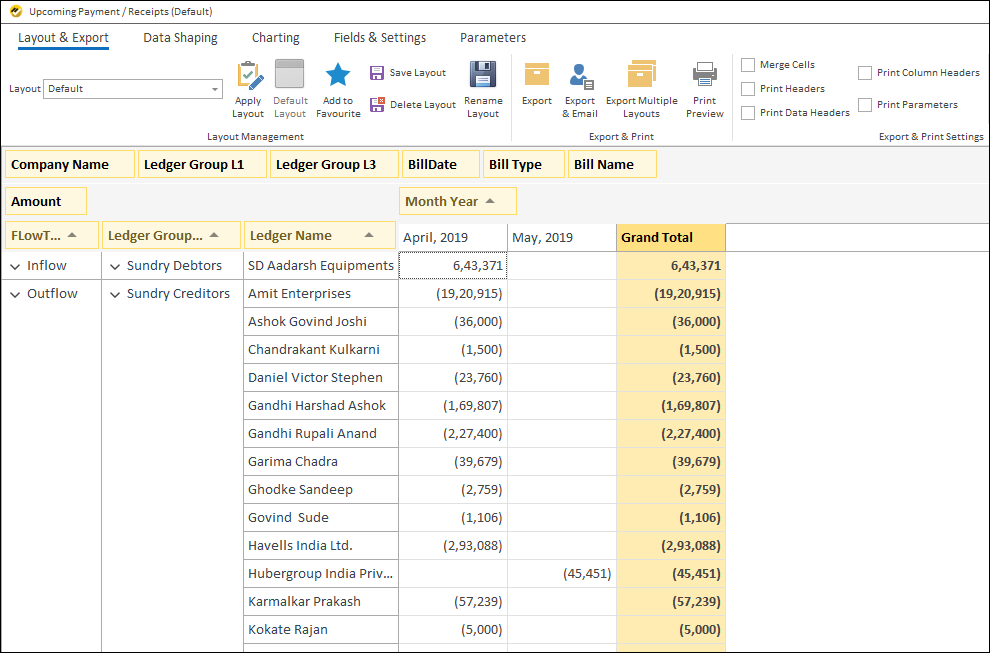

Cash Flow / Fund Flow Management

Upcoming Payments and Receipts

Helps Company To:

- Track all upcoming payments and receipts

- Better plan working capital needs

Other Options Available:

- Filter by company

- Summarize at group level

Configuration:

- Upload estimated variable costs for the month

- Upload recurring payments for the year

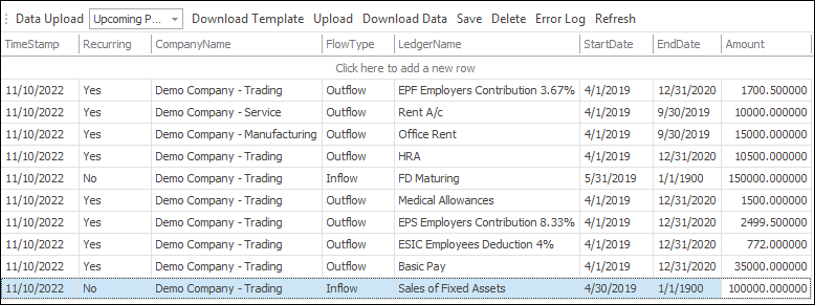

Additional Data Management – Upcoming Payments & Receipts

- Configure upcoming/recurring payments (e.g. salary, rent)

- Configure upcoming/recurring receipts (e.g. FD maturity, asset sales)

- Upload monthly estimated variable cost

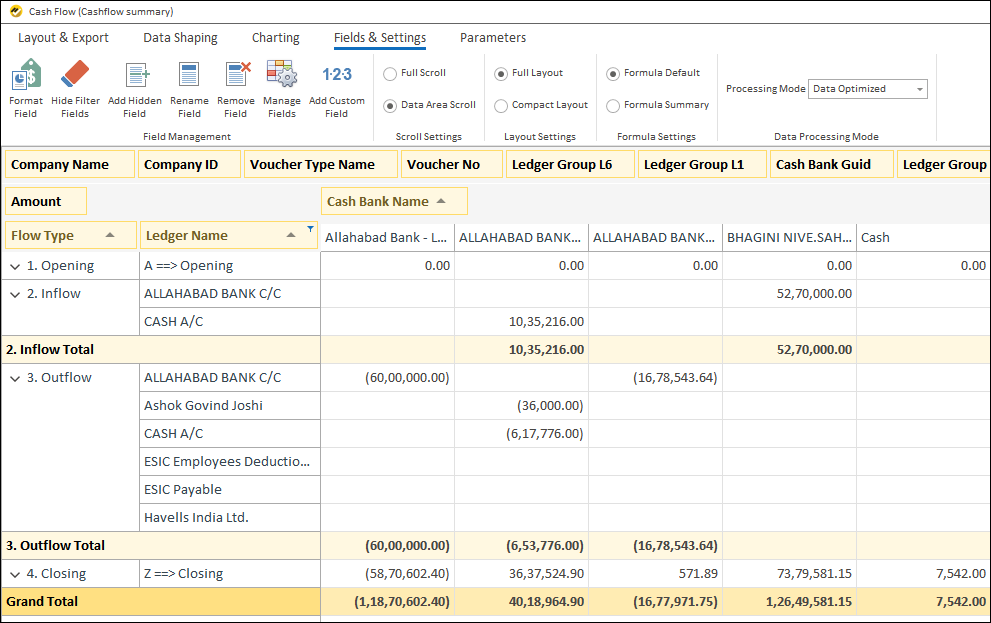

Cashflow Analysis

- Analyze cash flow using past data

- Understand inflow and outflow sources

Working Capital Management

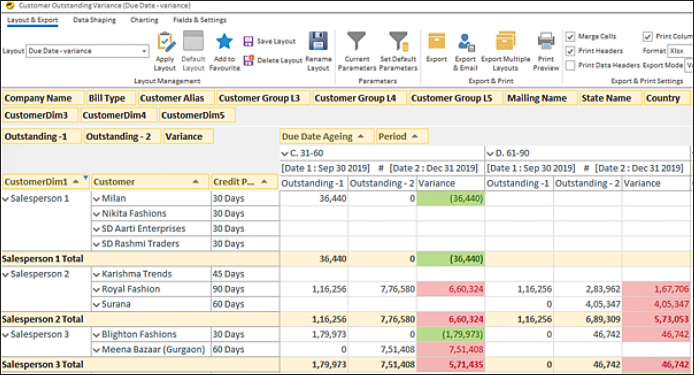

Customer Outstanding Variation

Helps Salesperson To:

- Identify parties with changing credit days

Helps Company To:

- Keep credit days within limits to reduce bad debts

- Improve working capital

- Summarize at salesperson level

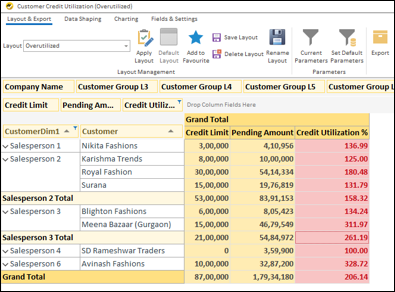

Customer Credit Utilization

Helps Salesperson To:

- Identify customers who exceeded credit limits

Helps Company To:

- Track credit utilization and ensure it’s within approved limits

- Improve working capital

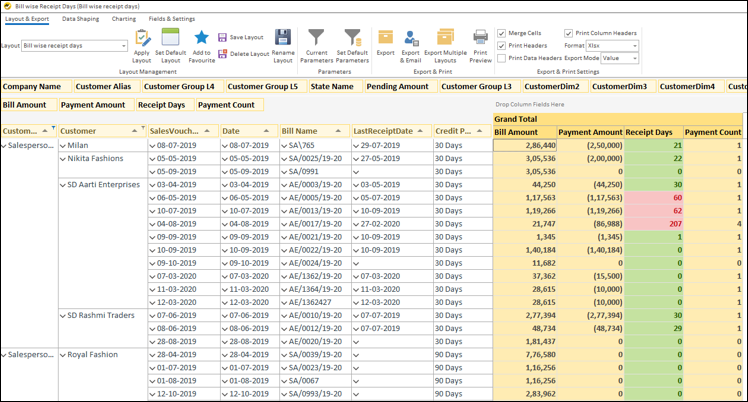

Bill-wise Receipt Days

Helps Salesperson To:

- View bill-wise receipt and credit days

- Track client credit performance

Helps Company To:

- Identify customers with poor payment history

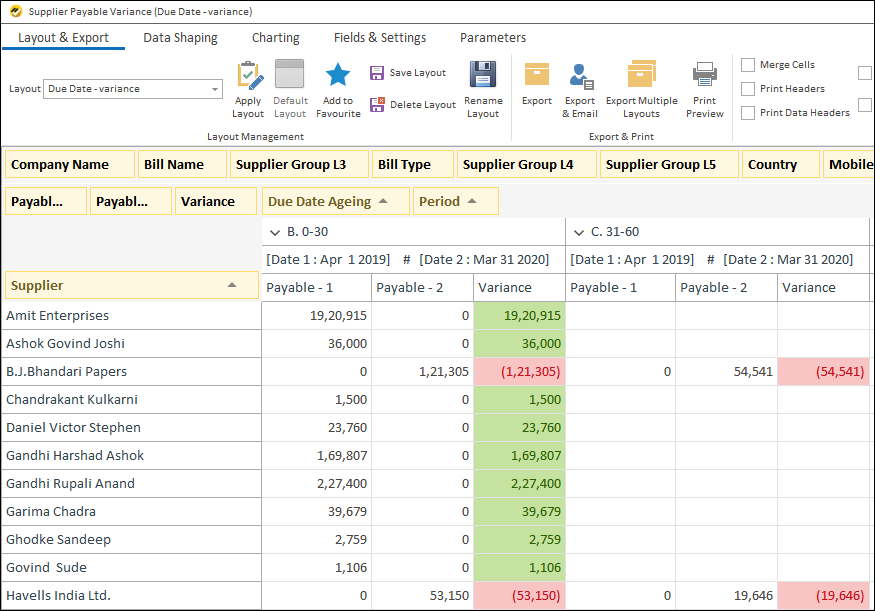

Supplier Outstanding Variation

- Ensure timely payments to suppliers

- Manage payments properly to maintain cash flow and credibility

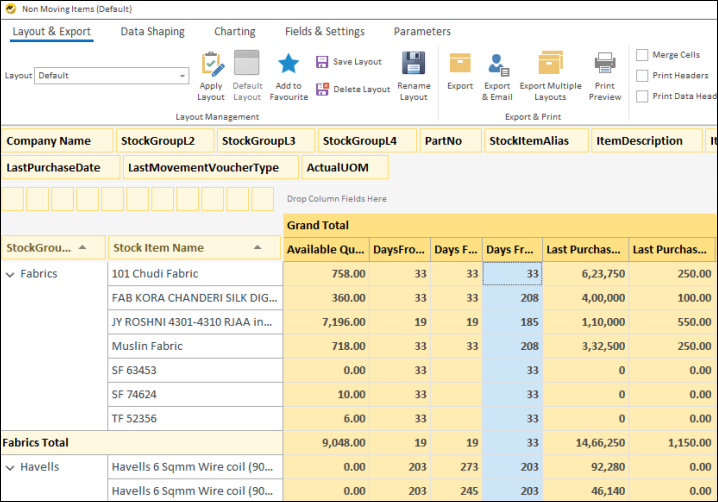

Non-Moving Items

Helps Company To:

- Identify items not sold for a set number of days

Other Options Available:

- Filter items not moving for the last N days

- Filter by company

- Filter by stock category

Stock Clearance

Helps Company To:

- Identify customers for clearance sale items

- Set sale prices based on last sale date and rate

Other Options Available:

- Filter by ageing bracket (e.g., items in stock for over 360 days)

- Filter by stock category