November 7, 2025

How to Automate Financial Reports for Small Business? To automate financial reports for small business, connect your data from ERPs like Tally, SAP B1, MS NAV to a BI reporting tool such as EasyReports. Next, map your chart of accounts, create reusable report templates and schedule automatic updates. This saves time, reduces manual errors and gives real-time visibility into financial business reports.

Why Manual Financial Reporting Is Killing Your Productivity?

- The Hidden Costs Nobody Talks About

Manual reporting introduces errors at every step. A misplaced decimal here, a wrong formula there, and suddenly your profit margin percentage looks lower than it actually is.

Then there’s the delay factor. By the time you finish compiling last month’s financial report, you’re already 15 days into the new month.

- The Spreadsheet Trap

When you have data scattered across for accounting, separate sheets for budgets, another system for inventory and maybe Google Sheets where your sales team tracks targets, getting everything into one coherent financial report becomes a puzzle.

The Right Way to Automate Financial Reports for Small Business

Step 1: Connect Your Data Sources

This is where most small businesses get stuck. Your financial data lives in multiple places, and manually pulling it together is the bottleneck.

The solution? Use a reporting tool that directly connects to your existing systems.

For example, if you’re using Tally, you need a tool that can read Tally, SAP B1 data in real-time without manual exports.

EasyReports does exactly this. It connects directly to Tally, SAP Business One, Microsoft NAV and Business Central & other data sources.

Step 2: Map Your Chart of Accounts

Most modern tools like EasyReports come with pre-built mapping for standard financial statements (Balance Sheet, P&L, Cash Flow). About Auto Mapping of 80-90 % of the ledgers to reporting heads based on pre-defined rules.

Step 3: Create Report Templates

This is where automation really starts to shine.

Instead of building each financial report from scratch every month, you create templates once. These templates define:

- How to structure it (rows, columns, groupings)

- What calculations to perform (margins, ratios, variances)

- How it should look (formatting, charts, colors)

Most small businesses need these core financial reports:

I) Income Statement (P&L): Shows revenues, expenses, and profit for the period. Include month-to-date, quarter-to-date, and year-to-date views.

II) Balance Sheet: Assets, liabilities, and equity at a point in time. Great for understanding your financial position.

III) Cash Flow Statement: Where money came from and where it went. This is often more important than profit for small businesses.

IV) Budget vs Actual: Compares what you planned to spend and earn versus what actually happened. Essential for staying on track.

With EasyReports, you can create these templates using a drag-and-drop interface. No coding required. The system even comes with pre-built templates for common financial statements, so you can start with those and customize them to match your specific needs.

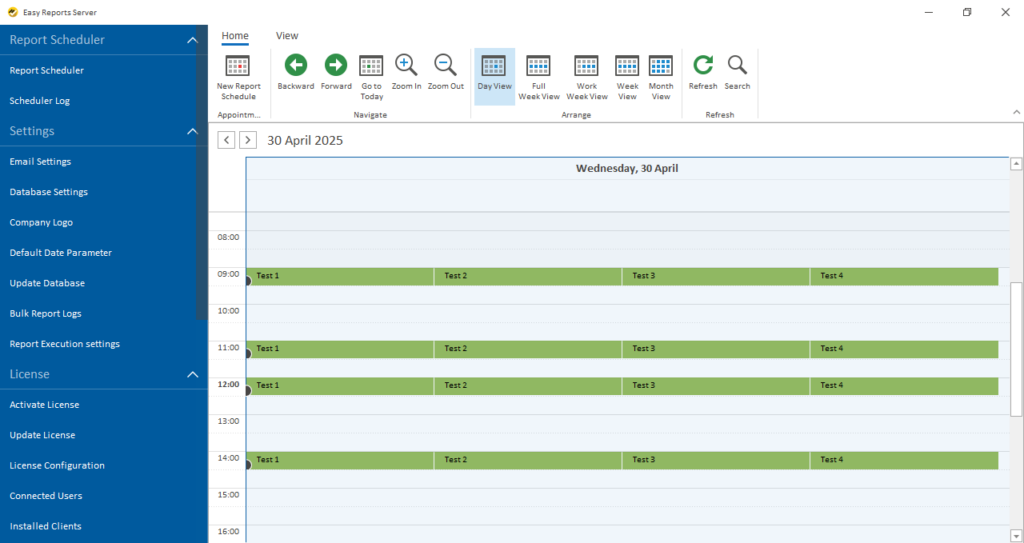

Step 4: Set Up Automated Scheduling

With EasyReports, schedule reports to be created and sent automatically.

Instead of preparing reports every week or month, you can fix a time and the system will do it for you. You can also choose to get the reports in Excel or PDF format directly in your email.

Step 5: Enable Self-Service Reporting

EasyReports also allows users to see reports on their own without waiting for someone else to prepare them. With self-service reporting, your team can check updated financial information instantly and make quicker decisions.

You deserve to spend your weekends doing literally anything except financial reporting.

Ready to make it happen? Start your free trial with EasyReports or get the demo now and see how quickly you can automate financial reports for small business without the usual headaches.

Frequently Asked Questions (FAQs)

1. Why should small businesses automate financial reports?

Automating financial reports saves time, reduces manual errors, and gives real-time visibility into business performance. It helps small businesses make faster and more accurate financial decisions.

2. Can I automate reports directly from Tally?

Yes. Using a BI tool like EasyReports, you can connect Tally data directly without manual exports. The tool reads your Tally data in real time and generates automated financial reports.

3. What are the main types of financial reports every small business needs?

The most common reports include the Income Statement (P&L), Balance Sheet, Cash Flow Statement, and Budget vs Actual Report. These provide a complete picture of your company’s financial health.

4. How does EasyReports help in automating financial reports?

EasyReports connects to Tally, SAP Business One, Microsoft NAV, and other systems. It auto-maps ledgers, offers ready-to-use templates, and lets you schedule reports automatically in Excel or PDF format.

5. Is technical knowledge required to use EasyReports?

No. EasyReports offers a drag-and-drop interface and pre-built templates, so you don’t need any coding or advanced technical skills to automate your reports.

6. Can I schedule reports automatically?

Yes. With EasyReports, you can schedule reports to be generated and emailed automatically on a daily, weekly, or monthly basis—saving hours of manual effort.