September 11, 2025

Monthly financial reporting is one of the most crucial responsibilities for every finance team. Yet, many businesses spend long hours compiling data, fixing spreadsheet errors and waiting for delayed insights. Studies show that finance teams spend up to 60% of their time preparing reports rather than analysing them. The good news? A smart financial reporting tool like EasyReports can change this. By automating data collection, consolidations and report generation, EasyReports helps businesses reduce monthly financial reporting time from days to just a few hours by saving time, reducing errors, and enabling faster decisions. In this blog, we’ll explore how to reduce monthly financial reporting time with reporting tool.

How a Reporting Tool Like EasyReports Can Help

A modern financial reporting software like EasyReports goes beyond basic automation—it delivers ready-to-use financial reports and powerful insights to save time, reduce errors, and boost decision-making speed.

Here’s how EasyReports transforms your monthly reporting process:

1. Automated Financial Statements

- Generate formatted Balance Sheets, Profit & Loss Statements and Cash Flow Statements directly from Tally, SAP B1, MS NAV & other ERP systems.

- Consolidate reports across multiple entities with intercompany adjustments for accurate group-level financials.

- Get comparisons with previous periods instantly for trend analysis.

Financial Benefit: Save hours of manual consolidation work and deliver error-free financial statements in minutes.

2. Budget vs Actual Analysis

- Upload annual, quarterly, or monthly budgets easily.

- Instantly track variance between budgeted and actual figures at the ledger or cost center level.

- Identify expenses exceeding budget limits or underperforming revenue areas quickly.

Financial Benefit: Helps control costs and ensures budget compliance for better financial planning.

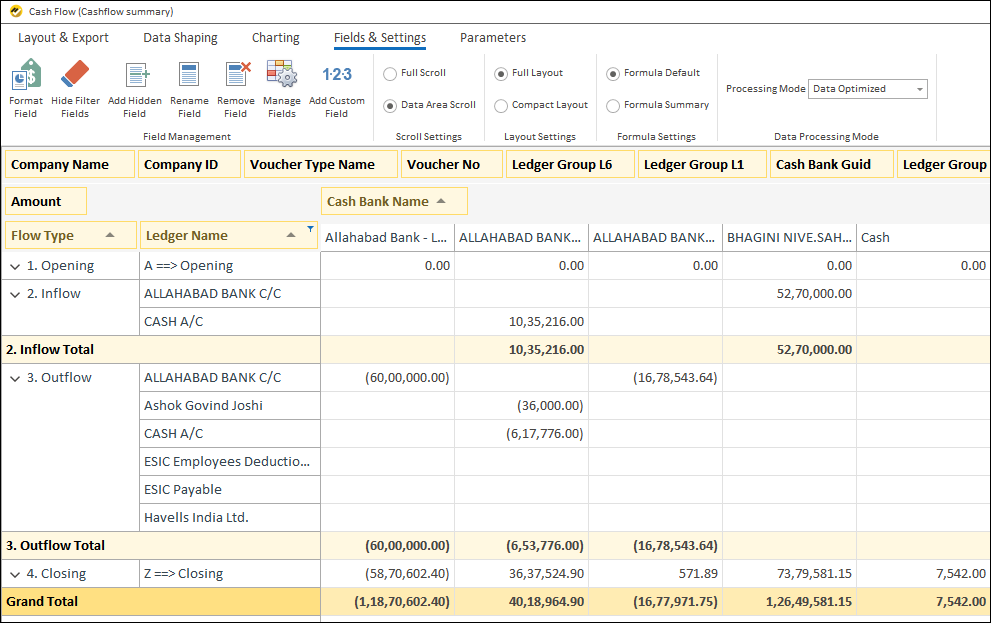

3. Cash Flow & Fund Flow Management

- Track upcoming payments and receipts for accurate cash flow planning.

- Analyze fund inflows and outflows to understand liquidity positions.

- Configure recurring expenses like salaries or rent to get realistic fund flow projections.

Financial Benefit: Improves liquidity management and prevents last-minute cash flow surprises.

4. Working Capital Optimization

- Monitor customer receivables and supplier payables to manage working capital effectively.

- Identify customers with delayed payments or overutilized credit limits to minimize bad debts.

- Track non-moving inventory and plan clearance sales for better fund utilization.

Financial Benefit: Reduces capital lock-in and boosts overall cash efficiency.

5. Expense and Variance Analysis

- Get expense registers with TDS, GST, and party-level details for reconciliation.

- Analyze expense variations month-over-month with alerts for abnormal spikes.

- Summarize reports at group or entity level for complete visibility.

Financial Benefit: Improves expense control and provides clear audit trails.

With EasyReports, monthly financial reporting shifts from being a manual, time-consuming activity to an automated, insight-driven process. Finance teams can:

- Eliminate repetitive tasks with automated data pulls and consolidated reports,

- Gain real-time visibility into cash flow, budgets, and expenses, and

- Empower management decisions with accurate, scheduled dashboards and alerts.

Book your free EasyReports demo today and experience how financial reporting automation can save time, cut errors, and boost strategic decision-making for your business.

FAQs

Most businesses rely on manual processes, scattered spreadsheets, and repetitive data compilation tasks. This results in long hours spent preparing reports instead of analyzing them for insights.

EasyReports automates data collection, consolidations, and report generation. It pulls real-time data from ERP systems like Tally, SAP B1, and MS NAV, creating accurate reports in minutes instead of days.

EasyReports generates:

- Balance Sheets

- Profit & Loss Statements

- Cash Flow and Fund Flow Reports

- Budget vs Actual Analysis

- Expense and Variance Analysis

- Working Capital Reports

Yes. EasyReports integrates with Tally, SAP B1, MS NAV, and other ERP systems. It also consolidates financial reports across multiple companies with intercompany adjustments.

You can upload budgets for different periods and instantly track variances between budgeted and actual figures at ledger or cost center levels. This helps in cost control and better financial planning.

Absolutely. It tracks receivables, payables, and upcoming expenses, giving real-time visibility into cash flow and helping optimize working capital.

Yes. EasyReports is designed for businesses of all sizes. It offers quick implementation, pre-built templates, and easy customization with minimal technical skills required.

EasyReports offers role-based access control and secure data management, ensuring sensitive financial information remains protected.