August 1, 2025

How to Automate Debtors Management from Tally Using a Reporting Tool? To automate debtors management from Tally. First, connect with a reporting tool like EasyReports to Tally using the built-in Tally Connector. Then, sync your company data to generate dashboards and detailed reports. Consequently, you can track customer payments, monitor credit limits, and improve cash flow efficiently, all in just a few clicks.

Table of Contents

- Debtors Reports in Tally

- What is EasyReports?

- Key Reports for Debtors Analysis in Reporting Tool like EasyReports

- Why Automate Tally Data Using a Reporting Tool

- How to Integrate Tally ERP Into a Reporting Tool

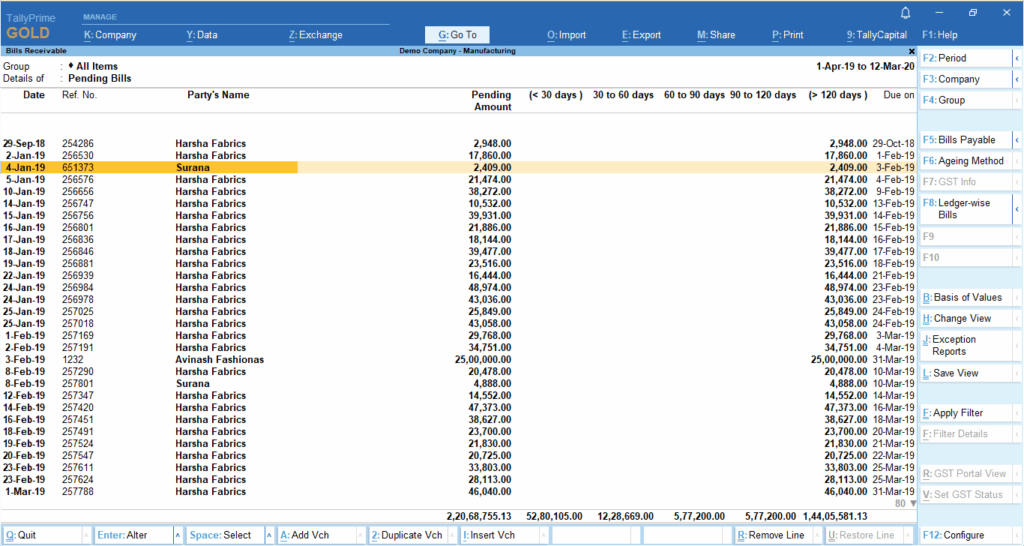

1) Debtors Reports in Tally

Here are the key reports you can generate in Tally for debtors (receivables) management:

1.1) Outstanding Receivables Report:

Shows each customer’s total outstanding balance as of the report date.

- Tally navigation: Gateway of Tally > Display More Reports > Statements of Accounts > Outstandings > Receivables

1.2) Age‑Wise Analysis (Customer Ageing):

Breaks down receivables into ageing buckets (e.g. 0–30, 31–60, 61–90, 90+ days).

- Tally navigation: For all Sundry Debtors (Group-wise):

- Gateway of Tally > Display More Reports > Statements of Accounts > Outstandings > Group

- Select Sundry Debtors from the list.

- Press F6 (Ageing Method) and choose either “Ageing by Bill Date” or “Ageing by Due Date”, then define your ageing periods.

- For a specific Customer (Ledger-wise):

- Gateway of Tally > Display More Reports > Statements of Accounts > Outstandings > Ledger

- Select the specific customer’s ledger.

- Press F6 (Ageing Method) and choose either “Ageing by Bill Date” or “Ageing by Due Date”, then define your ageing periods.

1.3) Statement of Accounts:

Essentially, this is a formatted statement that you can send to customers, showing all transactions and, consequently, the closing balance.

- Tally navigation: Gateway of Tally > Display More Reports > Account Books > Ledger, select the specific customer’s ledger.

1.4) Receipt Register:

Shows all receipt entries (payments received) mapped against customer invoices.

- Tally navigation: Gateway of Tally > Display More Reports > Account Books > Receipt Register

1.5) Sales Register:

Displays the monthly summary of sales transactions and closing balances.

- Tally navigation: Gateway of Tally > Display More Reports > Account Books > Sales Register

Also, other reports like Overdue Bills Report, Party‑Wise Ledger, Invoice‑Wise Outstanding Report. However, for advanced analytics, reporting insights, customization, scheduling & distribution a dedicated reporting tool like EasyReports is needed.

2) What is EasyReports?

EasyReports is a reporting and MIS automation tool for Tally, SAP B1, NAV, BC and other ERPs. It enhances your reporting capabilities. Moreover, it offers various standard and customizable reports, covering different areas of your business.

With EasyReports, you can automate debtors management from Tally and get reports/ dashboards all in a few clicks.

3) Key Reports for Debtors Analysis in Reporting tool like EasyReports

EasyReports provides an array of reports that delve into the specifics of customer payments and outstanding amounts. Let’s explore:

3.1) Active Inactive Customer:

Identifying active and inactive customers helps in focusing collection efforts.

Benefits:

- Firstly, it enables salespersons to track stuck payments and follow up with customers

- Secondly, it assists in identifying and re-engaging losing customers to regain sales orders

- Additionally, it lets sales teams monitor performance area-wise

- Finally, it supports the company in detecting salesperson-wise or state-wise troubled customers

3.2) Billing Efficiency:

Businesses can use this report to evaluate the effectiveness of their billing processes and identify areas for improvement.

Benefits:

- Helps company to track billing efficiency of a salesperson with key metrics like total invoices, avg amount per invoice (Ticket size), new customer added, outstanding, last sales

- Helps salesperson to Track billing efficiency of their parties

3.3) Customer Credit Utilization:

Moreover, understanding how much credit customers are using against their allocated limits is crucial for managing exposure and preventing over-extension.

Benefits:

- Firstly, it helps the salesperson to identify parties who have exceeded their credit limits

- In addition, it helps the company to track credit utilization of each customer and ensure they remain within approved limits

- Consequently, this allows the business to better manage overall working capital requirements

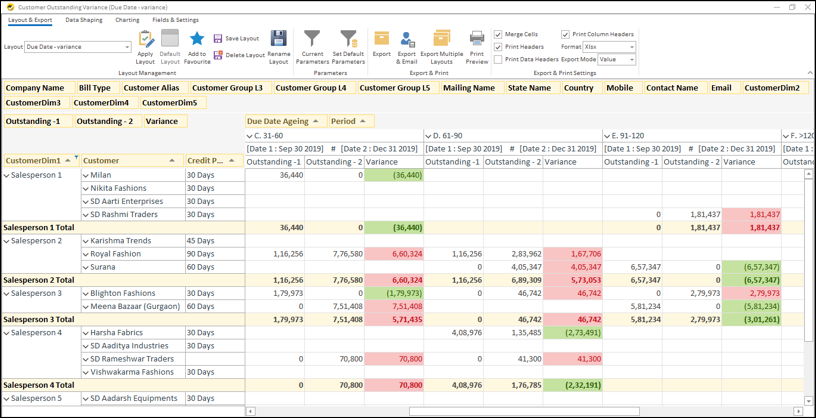

3.4) Customer Outstanding Variance:

Specifically, this report highlights significant changes or discrepancies in customer outstanding amounts over time. As a result, it signals potential issues or emerging trends, helping you take timely action.

Benefits:

- Firstly, it helps the salesperson to identify parties with increasing or decreasing credit days and take appropriate action to ensure credit days remain within the set limits

- Furthermore, it helps the company ensure that customer outstanding amounts stay within the allowed credit days, thereby minimizing the possibility of losses due to bad debts

- As a result, businesses can better manage their overall working capital requirements and finally summarize these insights at the salesperson level

3.5) Bill wise Receipt Days:

Specifically, this report analyses the time taken for customers to pay individual bills. Consequently, it offers valuable insights into payment patterns and highlights potential delays, enabling proactive management of receivables.

Benefits:

- Helps Salesperson to Get bill wise receipt days of the

- relevant parties along with their credit days

- Track credit performance of client

- Helps Company to Get details of customer with troubled payment history i.e. who are not making payments as per credit period

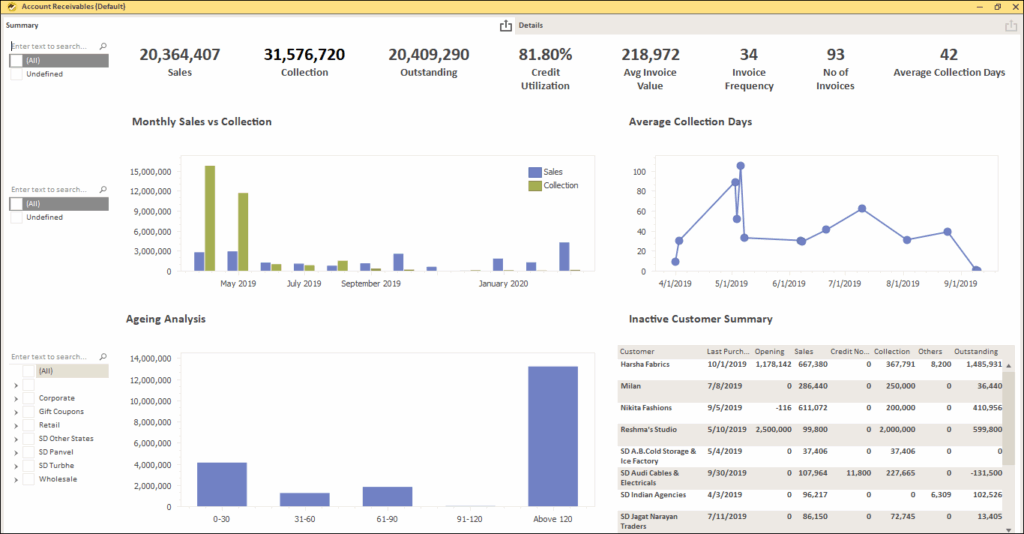

3.6) AR Dashboard:

The Accounts Receivable Dashboard offers a dynamic debtors management metrics.

Benefits:

- It visually presents key performance indicators like total Sales, Collection, and Outstanding amounts, alongside the Credit Utilization percentage

- The dashboard also includes insightful charts such as Monthly Sales vs. Collection, Average Collection Days, and Ageing Analysis & more providing a clear picture of cash flow patterns and the age of outstanding debts

3.7) Customer Performance:

This fixed type report provides a detailed “Statement of Accounts” for a specific customer, displays total Sales, Receipts, and the customer’s Credit Limit, along with the calculated Credit Utilisation and Last Sales Date & more.

Benefits:

- Businesses can assess overall customer financial behaviour, through this report

Also, many other reports like Customer Sales Collection Outstanding, Customer Transaction, Active Inactive Customer Item, Customer Master, Customer Outstanding, Customer Outstanding (Foreign Currency), Collection Forecast, Customer Bill Transaction. All of these reports help you automate debtors management from Tally more effectively, saving time and improving visibility.

4) Why Automate Tally Data Using a Reporting Tool

- Firstly, effortlessly import masters, transactional data, and stock details from Tally

- Next, access reports and dashboards covering almost all areas of Tally

- Finally, import custom fields (UDFs) from Tally and integrate them seamlessly

5) How to Integrate Tally ERP Into a Reporting Tool

Reporting tool like EasyReports comes with a built-in Tally Connector that directly connects to the Tally ERP system. Additionally, it syncs company data from Tally and securely stores it in the EasyReports database on the user’s system. Once the data is synced, users can open EasyReports to explore, analyse and generate meaningful reports from their Tally data with ease.

If your business relies on Tally ERP, then it’s time to take the next step and automate debtors management from Tally. Moreover, by leveraging detailed reports, you can transform your debtors management process from reactive problem-solving to proactive financial control. As a result, your business gains improved visibility, faster collections, and stronger cash flow management. Get your demo now!

Frequently Asked Questions (FAQs)

1) Why is automating debtors management important?

Automating debtors management ensures timely tracking of customer payments. Moreover, it improves cash flow, minimizes financial risk, and reduces manual errors in monitoring receivables.

2) How can a reporting tool like EasyReports help automate debtors management from Tally?

EasyReports imports Tally data and provides dashboards along with detailed reports. Additionally, it tracks outstanding payments, monitors credit utilization, and helps identify active or inactive customers. Therefore, it saves time and improves visibility.

3) What are the key reports for debtors analysis in EasyReports?

Key reports include:

– Active Inactive Customer

– Billing Efficiency

– Customer Credit Utilization

– Customer Outstanding Variance

– Bill-wise Receipt Days

– AR Dashboard (Accounts Receivable)

– Customer Performance

– Customer Sales Collection Outstanding

– Customer Transaction

– Collection Forecast

Furthermore, each report provides insights to support faster and data-driven decision-making.

4) What insights can I get from the Customer Outstanding Variance and Bill-wise Receipt Days reports?

Customer Outstanding Variance: Highlights increases or decreases in customer outstanding amounts, helping identify potential risks or trends.

Bill-wise Receipt Days: Shows the time customers take to pay individual invoices. As a result, it helps track credit performance and payment delays more effectively.

5) How do I integrate Tally ERP into EasyReports?

EasyReports comes with a built-in Tally Connector. It securely syncs company data from Tally to EasyReports. Consequently, users can generate reports, dashboards, and analytics directly from Tally data in just a few clicks.

6) How do I get started with EasyReports for automating debtors management?

To begin, install EasyReports and connect it with Tally ERP using the Tally Connector. Next, sync your company data and start generating reports and dashboards for automated debtors management. As a result, your reporting becomes faster, more accurate, and effortless.