August 2, 2023

Why Cost Centre Reporting in Tally is Important for Every Business? Cost Centre Reporting in Tally helps businesses track and analyze expenses for specific areas, departments, or projects. It is especially useful for service-based industries like IT, BPO, Media, and Infrastructure. This feature allows you to compare budgets with actual costs and revenues, helping you improve cost control and decision-making.

What is a Cost Centre?

A cost centre is a specific unit or department in a business that incurs costs. Using Cost Centre Reporting in Tally, you can track both revenue and non-revenue items, ensuring accurate financial monitoring.

If you enable the option “Allocate Non-Revenue Items” and set it to “Yes,” Tally will allow you to track even balance sheet items with cost centres.

Common examples include:

- Production departments

- Marketing and Sales

- Administration

This ensures that every department’s expenses are properly categorized and analyzed.

What is a Cost Category?

A cost category in Tally allows you to group cost centres based on specific reporting needs. By default, Tally provides a Primary Cost Category, but you can create multiple categories for advanced tracking.

Example:

If your business needs to track by both location and department, you can create:

- Cost Category 1: Location (e.g., Kolkata, Delhi, Mumbai)

- Cost Category 2: Department (e.g., Marketing, HR, Accounts)

When entering vouchers, you can tag both categories to achieve multi-dimensional reporting.

When you enable the “Allocate Non-revenue items” option to “Yes” then you can even track balance sheet items with cost centres.

Examples of cost centres include production departments, marketing departments, and administrative departments. Cost centres are used to track expenses related to specific areas of the business, enabling businesses to monitor and manage costs more effectively.

How can you use multiple cost categories?

Suppose you are running a business which needs tracking by location and department both. In such cases you can define two cost categories – “Location” and “Department”. Under “Location” cost category you can create location cost centres and under “Department” cost category you can create department cost centres.

Thereafter you can make entries by tagging both location and department.

Other Use Cases for Cost Centres

You can use cost centres for tracking projects, budget code wise tracking and reporting, e.g. within a project sub-activity, machine or vehicle wise cost tracking, employee or salesperson wise cost tracking.

For software, IT, project, infrastructure, construction and other service companies, cost centre reporting is key to tracking performance of the business.

Reporting using Cost Centres

Tally also offers a range of reporting tools that businesses can use to analyze their expenses by cost centre. With Tally, businesses can generate reports that provide insights into their expenses across different cost centres. This information can be used to identify areas of the business where costs are high and make adjustments to reduce expenses.

How to Use Advanced Reporting on Cost Centres?

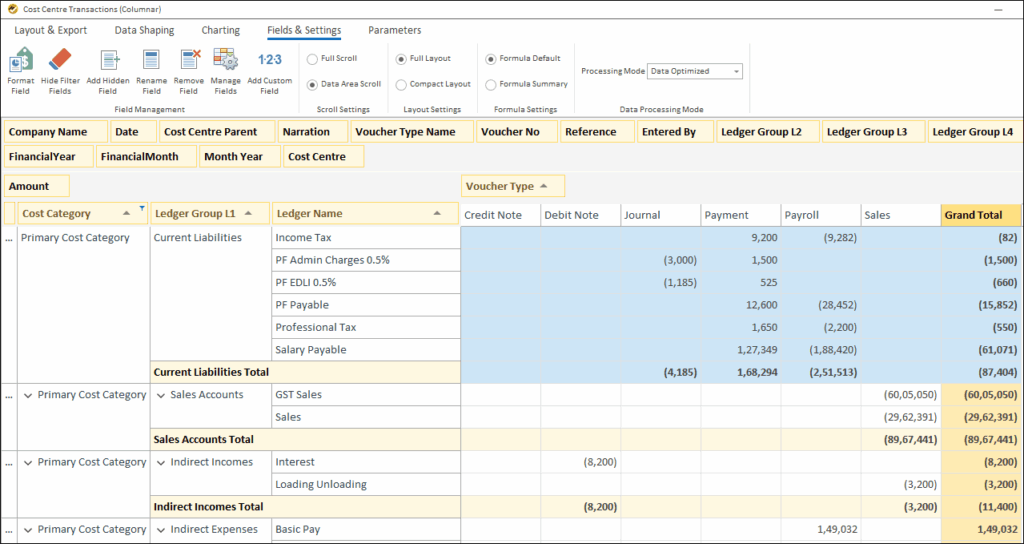

While Tally provides basic reporting using cost centres, EasyReports is a reporting automation tool which provides users with various different types of reports and report automation functions. With drag and drop reporting you can generate reports of your choice in seconds and combine data from ledgers and cost centres to create your specific MIS formats. It can also provide budget vs actual comparisons and financial statement and summaries based on cost centres.

An example of cost centre report is shown below where you can drag and drop and create your own reporting format with filters, sorting and sub-totalling:

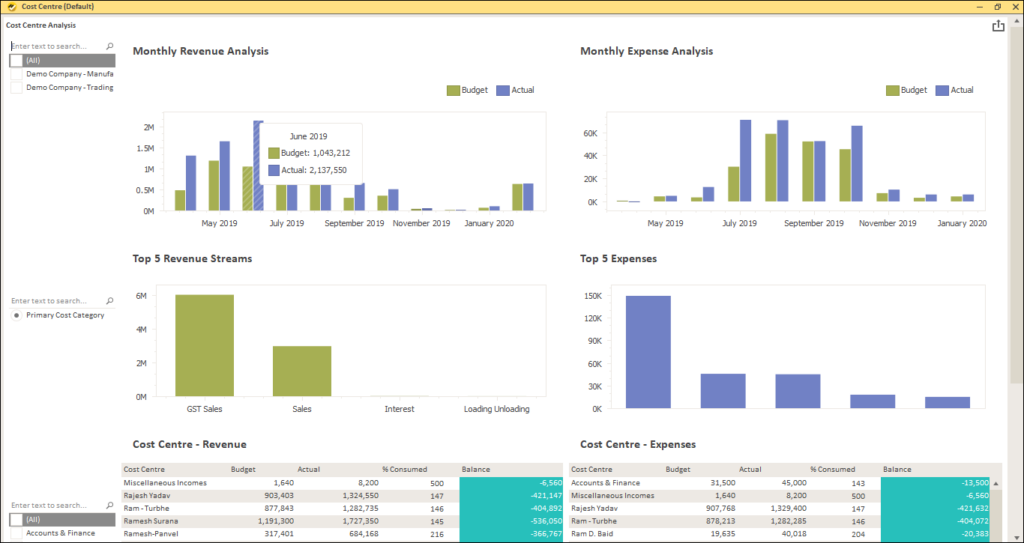

The following image is an example of a dashboard with cost centre data.

Cost centre reporting is an essential part of financial management for any organization. Tally offers a range of features to support cost centre reporting, enabling businesses to monitor and manage their expenses effectively. By using Tally for cost centre reporting, businesses can improve cost control, simplify accounting, and make better decisions based on accurate financial data. You can further use EasyReports to structure and automate your various cost centre reporting needs.

Disclaimer: This blog article is for educational purposes only. Tally is a product of Tally Solutions Pvt. Ltd. and we do not claim any affiliation.

Frequently Asked Questions (FAQs)

1. What is Cost Centre Reporting in Tally?

Cost Centre Reporting in Tally allows businesses to track and analyze expenses for different departments, projects, or business units. It helps identify where money is being spent and assists in better budgeting, cost control, and decision-making.

2. How do I enable Cost Centre Reporting in Tally?

To enable Cost Centre Reporting in Tally:

- Go to Gateway of Tally → F11: Features → Accounting Features

- Set Maintain Cost Centres to Yes

Once enabled, you can start assigning cost centres to your transactions.

3. What is the difference between a Cost Centre and a Cost Category in Tally?

A Cost Centre is a specific department or project where costs are tracked.

A Cost Category, on the other hand, is a higher-level group that helps organize multiple cost centres for multi-dimensional reporting — for example, by location or department.

4. How can Cost Centre Reporting help service-based businesses?

For service industries like IT, BPO, or construction, Cost Centre Reporting helps track project-based expenses, department budgets, and employee-wise performance, making financial tracking more transparent and efficient.

5. What are some advanced reporting options beyond Tally’s Cost Centre reports?

While Tally provides basic cost centre reports, tools like EasyReports BI offer advanced features such as drag-and-drop reporting, budget vs. actual comparison, automated dashboards, and combined ledger-wise reporting for deeper insights.

6. How does EasyReports enhance Cost Centre Reporting from Tally?

EasyReports simplifies cost centre reporting through automation and advanced analytics. You can generate customized MIS reports in seconds, track performance by multiple dimensions, and get interactive dashboards without complex setup.