July 25, 2025

Growing a startup is thrilling, but making the right decisions without clear data is tough. Are your business decisions truly data-driven? Management Information System (MIS) reports help bring that clarity. They turn raw business data into insights that guide smarter strategies. In this article, we’ll explore the Top MIS Reports for Growing Startups in a Reporting Tool like EasyReports and how they help startups scale efficiently.

What Exactly is an MIS Report?

An MIS report is an organized document that collects raw data from different parts of a business like sales, finance, or operations and turns it into useful information.

Types of MIS Reports for Growing Startups

MIS reports come in different types, each serving a special purpose to give useful insights:

- Financial Reports: They give a full view of a startup’s financial health. They usually include income statements (Profit & Loss), balance sheets, and cash flow statements.

- Sales Reports: They show how many products or services were sold in a certain time period.

- Inventory Reports: They help track product stock, best-selling items and demand across locations or customer types.

- Budget Reports: These reports cover different types of budgets like cash, income vs. Expenses or production budgets. They use internal company data to help guide business growth while keeping financial control.

- Production Reports: They show how much was produced, whether targets were met, and where there might be shortfalls.

Key MIS Reports for Growing Startups Using EasyReports

EasyReports leverages its powerful features to provide a suite of reports essential for growing startups, helping them gain smarter insights faster.

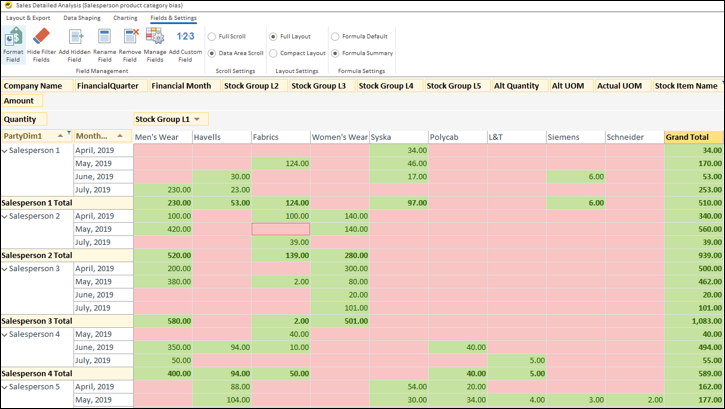

I) Sales & Debtors Reports: These provide insights into sales performance and outstanding payments. They track sales and debtors by sales person, area, channel, segment and location.

Benefits: This helps identify top performers and potential collection issues, enabling targeted sales strategies and improved cash flow.

II) Profitability Analysis: This allows for a deep dive into a business’s profitability. It analyzes profitability by customer, location, product, group, and salesperson.

Benefits: This helps in understanding which areas generate the most profit and which might be underperforming, guiding resource allocation and pricing strategies.

III) Targets & Budgets vs. Actuals: Essential for financial control and performance management. This feature compares sales, item, salesperson, revenue, and expense targets against actual performance.

Benefits: This is vital for budget variance analysis, identifying deviations, and making timely course corrections.

IV) Financial Statements: EasyReports generates essential financial reports like Balance Sheet, Profit & Loss (P&L), and Cash Flow statements.

Benefits: It supports complex financial reporting needs, including multi-currency, monthly columnar and consolidated financials.

V) Inventory Analysis: For product-based startups, this is crucial for optimizing stock. It provides insights into stock ageing, slow-moving, and non-moving stock clearance.

Benefits: This helps optimize inventory levels, reduce carrying costs, and prevent losses from obsolete stock.

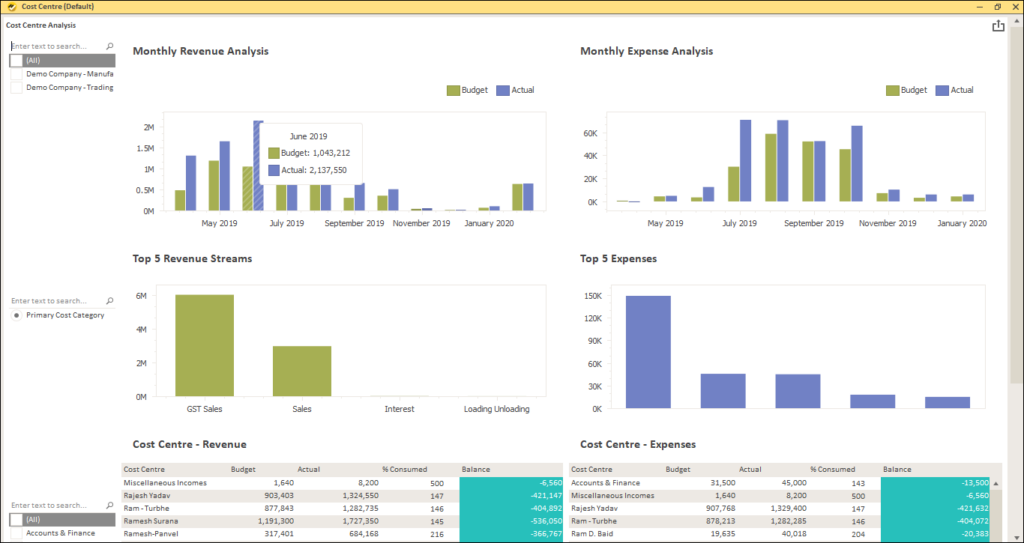

VI) Cost Centre Analysis: This analyzes costs, revenue and profitability by cost centre, providing detailed insights into specific processes, projects, or departments.

Benefits: This aids in monitoring operational efficiency and allocating resources effectively.

How to Automate MIS Reports for Startups

EasyReports simplifies the MIS process with automation.

Follow these simple steps:

- Connect your data sources (like Tally or ERP systems)

- Design & customize your MIS reports

- Schedule automatic delivery by email or dashboard

- Analyze and accelerate growth

Why MIS Reports Matter for Growing Startups

In today’s fast-moving environment, data-driven decisions can make or break a startup. MIS reports bring transparency, control, and actionable insights. Tools like EasyReports turn scattered data into structured intelligence helping startups grow smarter, faster, and stronger. Get your demo today!

Frequently Asked Questions

1. What is an MIS Report and why is it important for startups?

An MIS report turns data from sales, finance, and operations into insights. It helps startups make informed decisions and grow.

2. Which are the most important MIS reports for startups?

Key reports include Financial, Sales, Inventory, Budget, Production, Profitability and Cost Centre Analysis for complete business visibility.

3. How do MIS reports support financial management?

Reports like Financial Statements and Budgets vs. Actuals track income, expenses, and cash flows, ensuring financial control.

4. Can MIS reports help sales growth?

Yes. Sales & Debtors Reports provide insights on performance, outstanding payments, and top customers for targeted strategies.

5. How does EasyReports simplify MIS reporting?

EasyReports automates data collection, integrates with ERPs, and provides dashboards, saving time and improving accuracy.

6. What role does Inventory Analysis play?

It optimizes stock, identifies slow-moving items, and reduces carrying costs for efficient working capital management.

7. Can targets be compared with actual performance?

Yes. Targets & Budgets vs. Actuals reports identify gaps, analyze variances, and guide corrective actions.

8. How can startups start using EasyReports?

Connect data sources, customize reports, schedule delivery, and analyze results. Book a free demo on EasyReports website.