December 13, 2024

What are the top 5 accounting features of Tally Prime? Tally Prime offers powerful accounting features that make financial management simple and accurate for businesses of all sizes. The top 5 accounting features of Tally Prime include Multiple Cost Categories and Cost Centres for tracking expenses by project or employee, Bank Reconciliation for quick and automated matching of transactions, Multi-Currency Support to handle global payments easily, GST and Taxation for seamless compliance and automatic tax calculation, and Credit Management to monitor customer credit limits and payment performance.

1. Accounting Features of Tally Prime: Multiple Cost Categories and Cost Centres as Sub-ledgers

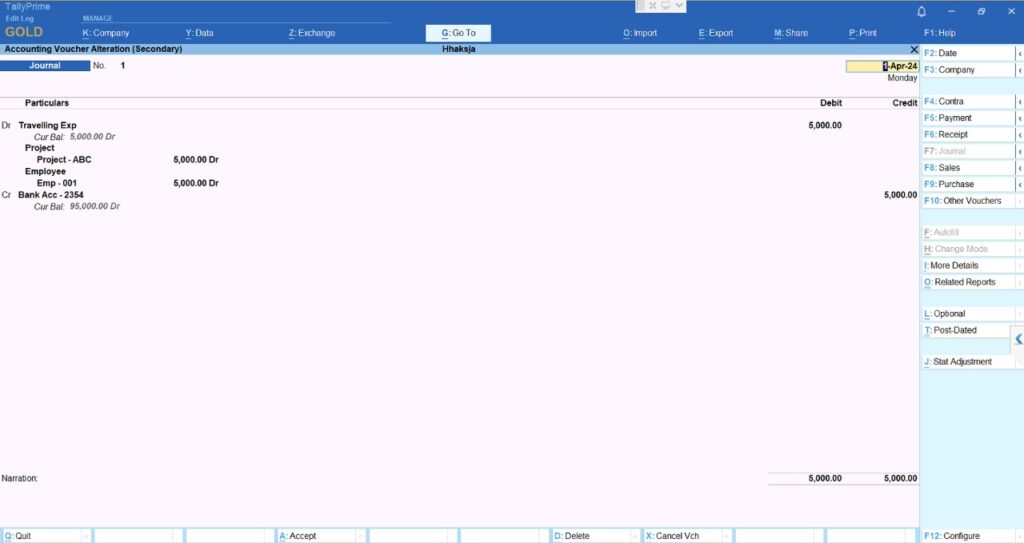

Using multiple Cost Categories and Cost Centres as the Sub-ledgers, this feature allows you to analyze expenses from multiple perspectives.

Example: If You want to track the “Travelling Expenses” ledger by employee and project, you can create two cost categories called “Employee” and “Project” and create individual Cost Centres. Then, Under each category, you can add specific employees and project names as Cost Centres. Finally, When you pass transactions you can tag the employee and project against the ledger “Travelling Expenses” to get breakup by Project or Employee.

While the above is an example you can use this type of configuration to cater to multiple different scenarios and reporting needs

How to Access Multiple Cost Categories and Cost Centres as Sub-ledgers in Tally Prime?

Based on the above example you can access the Tally menu navigation given below:

- Firstly, Create Cost Categories: Go to Gateway of Tally : Under Masters select Create : Choose Cost Categories : Create two Cost Categories : Employee and Project.

- Secondly, Create Cost Centres: Under the Employee category, create individual Cost Centres for each employee. Under the Project category, create individual Cost Centres for each project.

- Finally, Assign Cost Centres to Ledger: At the making entry, tag the Cost Centres under the appropriate Cost Categories for the ‘Travelling Expense’ Ledger.

Key Benefits:

- This helps you see a clear breakdown of Cost expenses

- Create custom cost categories and sub-ledgers as per business needs

2. Accounting Features of Tally Prime: Bank Reconciliation

This feature helps businesses match their cashbook with bank statements. It stands out as one of the top 5 accounting features of Tally.

How to Access Bank Reconciliation in Tally Prime?

- Firstly, Gateway of Tally : Account Books : Under Summary select Cash Bank Books.

- Secondly, Select the Bank Account option and set the Period for Reconciliation (Alt R).

- Finally, Import the bank statement and match transactions.

Key Benefits:

- Saves time with automated matching.

- Identifies mismatches instantly.

- Improves financial accuracy and audit readiness.

3. Accounting Features of Tally Prime: Multi-Currency Support

This feature allows businesses to manage transactions in different currencies & crucial for companies dealing with international clients or suppliers.

How to Use Multi-Currency in Tally Prime?

- Firstly, Gateway of Tally : Under Masters Select Alter or Create: For Currency creation and Alteration

- Secondly, After creation of a currency, you may enter the exchange rate and currency details.

Transaction Entry Using Multi-Currency:

- Firstly, Define the Exchange Rate: Go to Gateway of Tally : Select Alter Currency : Enter the exchange rate for the currency relative to your base currency.

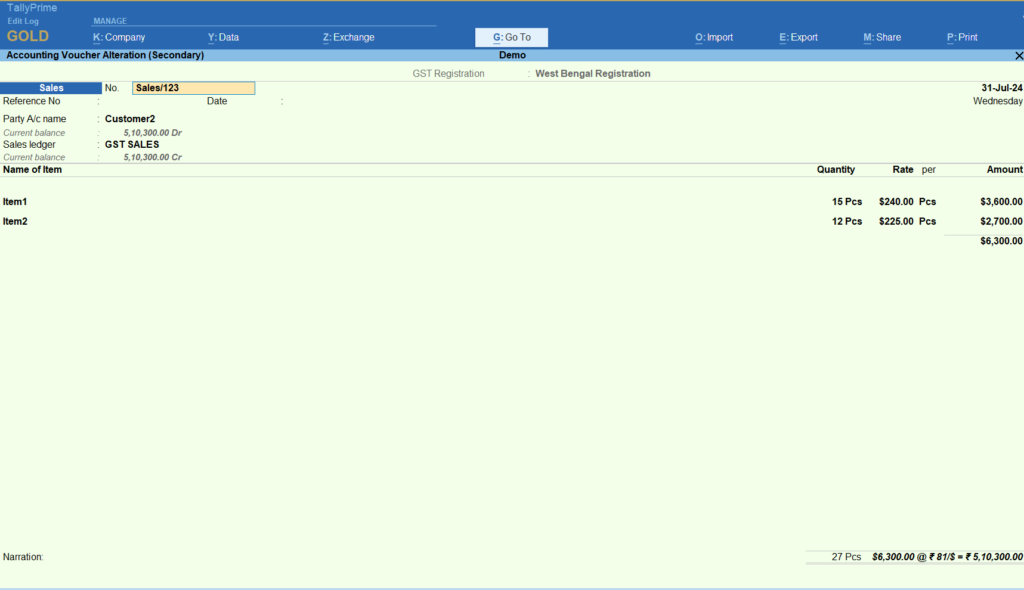

- Secondly, Record Transaction: Go to Gateway of Tally: Select Accounting Vouchers : Select Voucher For example Sales (F5), before entering the Amount value set the Currency under exchange Rate and proceed.

Key Benefits:

- Handles multiple currencies with ease.

- Automatic currency conversion.

4. Accounting Features of Tally Prime: GST and Taxation

GST and Taxation strengthen one of the top 5 accounting features of Tally. In addition, It calculates taxes automatically on invoices and prepares GST reports that are ready for filing.

Latest GST feature in Tally Prime 5.1:

- Enhances GST compliance with advanced E-Way bill management.

- Directly upload and file returns using TallyPrime 5.1.

How to Enable and Use GST in Tally Prime?

- Firstly, Gateway of Tally: F11 (Features): Enable GST (Set it to “Yes”).

- Secondly, Gateway of Tally: Under Transactions select Vouchers : Sales or Purchase Voucher (depending on the transaction).

- Finally, Enter GST details while recording the voucher.

- For GST Reports: Gateway of Tally: Display : Statutory Reports : GST Reports.

Key Benefits:

- Automatic GST calculation.

- Ready-to-file GST reports.

- Supports TDS and TCS compliance.

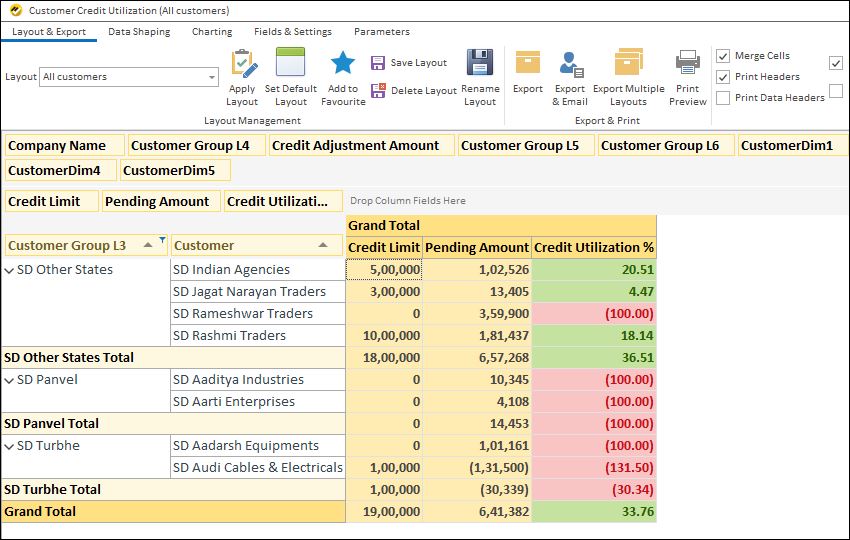

5. Accounting Features of Tally Prime: Credit Management

Tally offers you credit limit and credit days tracking where you can set these up in the customer master. Moreover, You can also use the average payment days against a customer to see the payment performance of the customer.

How to Access Credit Management in Tally Prime?

- Set Credit Limits and Credit Days: Go to Gateway of Tally : After that Under Masters : Choose Ledgers- Create or alter the ledger for the customer or supplier : In the ledger creation/alteration screen, go to the Budgets and Controls section : Set the Credit Limit and Credit Days for the party

Key Benefits:

- Set Credit Limits: Define credit limits for customers to prevent over-crediting and reduce payment risks.

- Customizable Credit Periods: Set specific credit periods for customers, ensuring flexibility in payment terms.

These are the top 5 accounting features of Tally which help businesses stay financially organized.

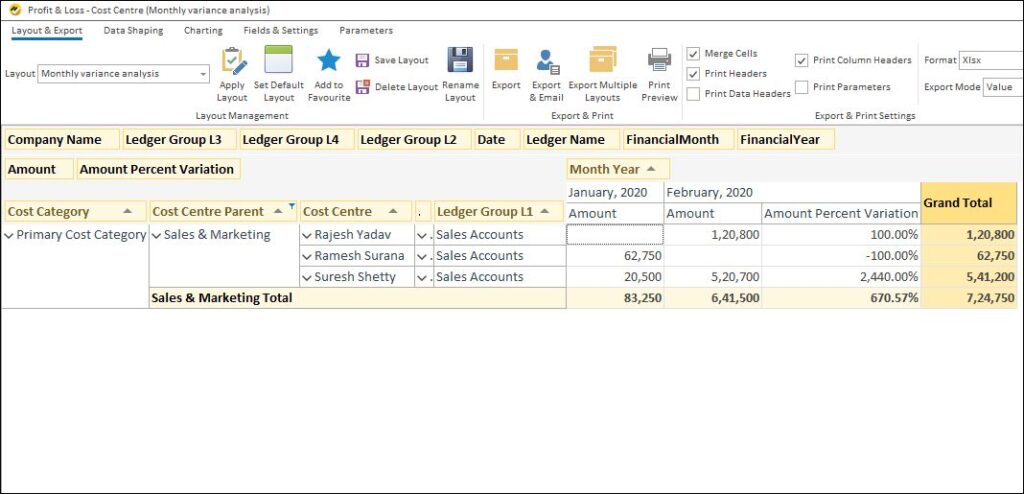

How to utilize these above Tally Accounting features in BI Reporting Tools?

With BI tools like EasyReports, you can generate detailed, customizable and real-time accounting reports that help you make better financial decisions. Moreover, You can get reports in EasyReports for the above-mentioned top 5 accounting features of Tally are given below:

- Profit & Loss – Cost Centre: Track profitability across multiple cost categories.

- Bank Reconciliation Statement: Simplify bank reconciliation by matching bank entries with Tally records.

- TDS Register: Manage taxation with a clear view of TDS deductions.

- Customer Credit Utilization: Monitor customer credit usage to improve credit control.

- Supplier Payable (Foreign Currency): Track supplier payments in multiple currencies.

EasyReports offers you many other standard and customized reports and MIS options. To learn more, feel free to connect with the author at info@orchidtec.in

Disclaimer: This blog article is for educational purposes only. Tally is a product of Tally Solutions Pvt. Ltd. and we do not claim any affiliation.

Frequently Asked Questions (FAQ)

Q1: What are the top 5 accounting features of Tally Prime?

A: The top 5 accounting features of Tally Prime include Multiple Cost Categories and Cost Centres for detailed expense tracking, Bank Reconciliation for quick and accurate matching of transactions, Multi-Currency Support for handling international payments, GST and Taxation for automatic tax calculation and compliance, and Credit Management to monitor customer credit limits and payment performance. These features help businesses manage their finances efficiently and accurately.

Q2: How does EasyReports BI enhance Tally Prime?

A: EasyReports BI enhances Tally Prime by automating report generation, offering real-time dashboards, and providing advanced analytics for cost, bank, GST, and credit data. This helps businesses gain deeper insights and make faster, informed financial decisions.

Q3: Can I automate data from Tally with EasyReports?

A: Absolutely! EasyReports allows users to automate Tally report generation, schedule reports, and export data in formats like PDF or Excel, reducing manual effort and saving time for businesses.