November 22, 2024

What are the top 5 customer reports in Tally? The top 5 customer reports in Tally are Bills Receivables, Sales Register, Customer Ledger, Ageing Analysis, and Customer Confirmation of Accounts.

Tally is one of the most widely used accounting and financial management tools in India. Its powerful reporting features make it easier for businesses to monitor their performance and manage customer relationships. In this blog, we’ll explore the top 5 customer reports from Tally, which help businesses stay on top of their receivables and sales.

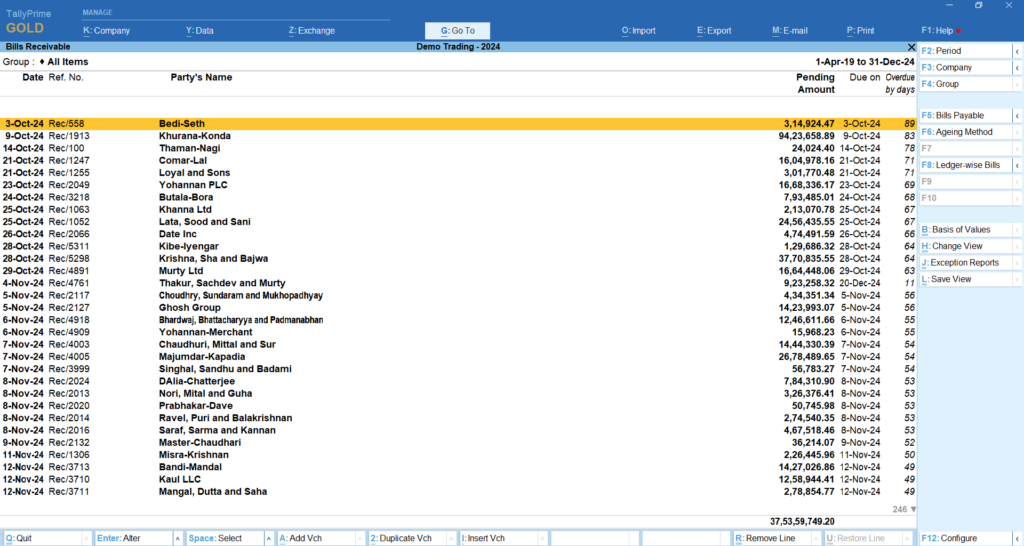

1. Bills Receivables

The Bills Receivables report helps you track all outstanding payments from your customers. It shows the details of unpaid invoices, due dates, and the total amount receivable. This report ensures you stay on top of pending collections and plan your cash flow effectively.

How to Access Bills Receivables in Tally:

Go to Gateway of Tally -> Select Display -> Navigate to Statement of Accounts -> Choose Outstanding ->Select Receivables

Use this report to monitor pending payments and improve cash flow management.

2. Sales Register

The Sales Register provides a detailed view of all sales transactions over a specific period. It includes details like invoice numbers, dates, and amounts. This report helps you monitor sales performance and identify trends in customer purchases, making it easier to strategize and grow your business.

How to Access Sales Register in Tally:

Go to Gateway of Tally->Select Display->Navigate to Account Books->Choose Sales Register

This report helps track sales trends and identifies customer purchasing behaviors.

3. Customer Ledger

The Customer Ledger is a detailed account of all transactions with a specific customer. It includes invoices, payments, and outstanding balances, providing complete transparency in your dealings. This report is particularly useful for resolving disputes and maintaining healthy customer relationships.

How to Access Customer Ledger in Tally:

Go to Gateway of Tally->Select Display->Navigate to Account Books->Choose Ledger->Select the customer’s name from the list

This report is useful for resolving disputes and maintaining clear communication with customers.

4. Ageing Analysis

The Ageing Analysis report breaks down outstanding amounts into categories based on how long they’ve been overdue (e.g., 0-30 days, 31-60 days). It helps you prioritize follow-ups and identify customers with delayed payments, allowing you to take timely actions to recover dues.

How to Access Ageing Analysis in Tally:

Go to Gateway of Tally->Select Display->Navigate to Statement of Accounts->Choose Outstanding->Select Receivables-> Ageing Method(F6) -> Under Ageing Analysis select method of Ageing

This report allows you to prioritize follow-ups with customers based on overdue durations.

5. Customer Confirmation of Accounts

The Customer Confirmation of Accounts report helps verify balances and transactions with customers at the end of a financial period. It ensures that all parties are aligned on the outstanding amounts and account details.

How to Access Customer Confirmation of Accounts in Tally:

Go to Gateway of Tally->Select Display-> then Account Books->Choose Ledger-> Select Alt(P) to print the Ledger -> Click Configure Button -> Select Report Type as Confirmation of Accounts

This report is essential for financial audits and maintaining accurate records. It also builds trust with your customers by ensuring transparency.

These top 5 customer reports from Tally help businesses manage customers and track their financial interactions effectively. However, with reporting and BI tools, you can analyze customer average payment days, customers who have become inactive for n days, customer-wise item-wise sales history reports, average rate movement reports, salesperson-wise performance or geography-wise insights, etc. If your business has some custom requirements the same can also be addressed with these tools.

What is EasyReports BI?

EasyReports is a reporting and MIS automation tool for Tally, SAP B1, NAV, BC and other ERPs. It enhances your reporting capabilities & offers various standard and customizable reports around different areas of your business.

So, above we have discussed the new features for Tally Prime 6.0 latest version. Tally is undoubtedly a powerful software, but if you’re looking to take your reporting and data analysis to the next level, integrating EasyReports BI with Tally Prime can be a game-changer. Visit www.easyreports.in to book a free demo and experience it for yourself!

Disclaimer: This blog article is for educational purposes only. Tally is a product of Tally Solutions Pvt. Ltd. and we do not claim any affiliation.

FAQs – Customer Reports in Tally

1. What is the Bills Receivables report in Tally?

The Bills Receivables report in Tally shows all outstanding payments from your customers. It includes invoice numbers, due dates, and total amounts receivable. This report helps manage collections efficiently and maintain healthy cash flow.

2. How can I view the Sales Register in Tally?

You can access the Sales Register by navigating to Gateway of Tally → Display → Account Books → Sales Register. It displays all sales transactions, helping you analyze sales trends, customer performance, and business growth over time.

3. What is the purpose of the Customer Ledger in Tally?

The Customer Ledger provides a complete view of all transactions with a specific customer, including invoices, receipts, and outstanding balances. It is useful for resolving disputes and ensuring accurate account reconciliation.

4. How does the Ageing Analysis report help in Tally?

The Ageing Analysis report in Tally categorizes outstanding receivables based on the number of days overdue (for example, 0–30 days, 31–60 days). This helps prioritize follow-ups and manage overdue payments more effectively.

5. What is the Customer Confirmation of Accounts report in Tally?

The Customer Confirmation of Accounts report helps verify balances and transactions with customers at the end of a financial period. It is essential for audits, financial accuracy, and building trust with customers through transparent reporting.

6. Can I generate more advanced customer reports beyond Tally’s default options?

Yes. While Tally offers essential customer reports, EasyReports BI enhances reporting with advanced insights such as customer-wise item sales history, average payment days, salesperson performance, and inactive customer tracking. You can also create custom dashboards and automate MIS reports for faster decision-making.