December 16, 2019

How to generate a GST Sales Invoice in Tally? To generate a GST Sales Invoice in Tally ERP9, go to Gateway of Tally → Accounting Vouchers → F8: Sales. Select the Party Ledger, choose the relevant Sales Ledger, add your items, quantities, and rates, then select the applicable tax ledgers. You can configure additional details with F12, view the tax break-up with A and F1, and finally print the invoice using Alt+P. Use Alt+C to print multiple copies. This process ensures your invoices are fully GST-compliant.

GST, or Goods and Services Tax, has transformed the way businesses manage taxes in India. With the introduction of GST on 1st July 2017, it became mandatory for businesses to generate GST-compliant invoices. One of the most popular tools to generate such invoices is Tally ERP 9. In this blog, we’ll guide you through the simple steps to create a GST Sales Invoice in Tally. Let’s get started! Let us explore how you can generate the GST Sales Invoice from Tally ERP9.

Why is GST Important?

GST replaced many indirect taxes in India, simplifying the taxation process for businesses. By keeping your sales invoices GST-compliant, you ensure your business is adhering to tax regulations while making it easy to track and file GST returns.

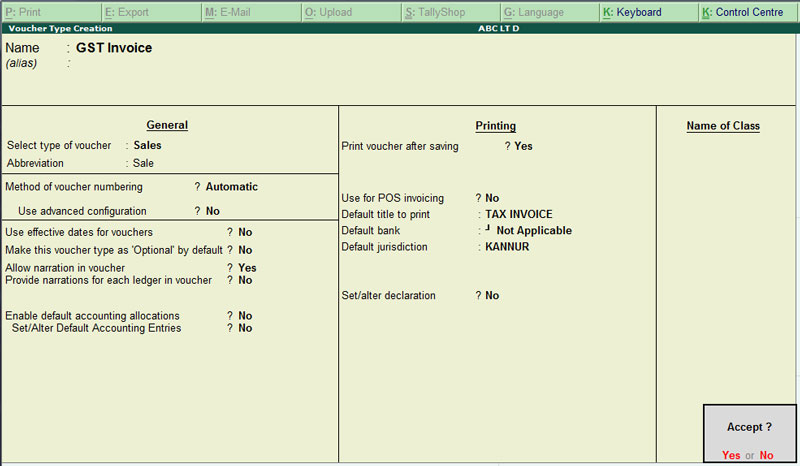

Here we have the steps to create Sales Invoice in Tally.ERP 9 for GST:

First step: Go to the Gateway of Tally (GOT)

Second step: Click on Accounting Vouchers

Third step: Select F8: Sales. (For invoice number, write the serial number of the bill)

Fourth step: Under Party A/C name column, select the party ledger or the cash ledger.

Fifth step: Select the relevant sales ledger (If it is local sale, then select sales ledger for local taxable sales and if it is interstate sale, then select the sales ledger for interstate sales)

Sixth step: Select the required items and specify the quantities and rates.

Seventh step: Select the central and state tax ledger, in case of local sales.

Eighth step: Depending on the user’s requirements, user can include additional details in their invoice by clicking F12: Configure such as buyer’s order no, delivery note no etc.

Ninth step: You can view the tax details by clicking A: Tax Analysis.

Tenth step: Click F1: To view the detailed tax break-up.

Eleventh step: Press Alt+P to print the invoice in the required format, in sales invoice.

Twelfth step: Press Alt+P and then Alt+C to select multiple number of copies.

Wrapping Up

These above-mentioned steps are the process of generate a GST Sales Invoice from Tally ERP9. Generating a GST sales invoice in Tally ERP 9 is simple when you follow these steps. This ensures that your invoices are fully compliant with GST regulations, helping you stay on the right side of the law while maintaining smooth business operations. Whether you’re new to Tally or looking to streamline your invoicing process, these steps will guide you every time!

By mastering this process, you’ll save time and reduce the chances of errors. If you haven’t already, start generating your GST invoices in Tally today! Also, to automate your Tally data instantly use a reporting tool like EasyReports. Learn more on www.easyreports.in

Disclaimer: This blog article is for educational purposes only. Tally is a product of Tally Solutions Pvt. Ltd. and we do not claim any affiliation

FAQs

1. How do I generate a GST sales invoice in Tally?

To generate a GST sales invoice in Tally ERP9, follow these steps:

- Go to Gateway of Tally → Accounting Vouchers → F8: Sales.

- Enter the invoice number.

- Select the Party Ledger.

- Choose the relevant Sales Ledger.

- Add items, quantities, and rates.

- Select the tax ledgers.

- Configure additional details using F12.

- View tax analysis with A and detailed break-up with F1.

- Print the invoice with Alt+P and multiple copies with Alt+C.

2. Why is GST compliance important for sales invoices?

GST compliance ensures your sales invoices follow Indian tax regulations, simplifies filing GST returns, and helps avoid penalties or legal issues.

3. Can I print multiple copies of a GST sales invoice in Tally?

Yes. Press Alt+P to print the invoice and then Alt+C to select the number of copies required.

4. Can I add additional details like buyer’s order number in a GST invoice?

Yes. Tally allows you to include additional details such as buyer’s order number or delivery note by pressing F12: Configure while creating the invoice.