May 23, 2025

Running a trading business is all about speed, accuracy, and smart decisions. You deal with purchases, sales, stock movement, suppliers, customer payments all in real-time. But here’s the truth: without reporting tool for trading businesses, you’re just reacting, not growing. In this blog, we’ll show you why trading businesses need a reporting tool.

What Is a Reporting Tool?

A reporting tool is software that automatically pulls your business data from systems like ERP’s and other data sources and gives you real-time reports, dashboards and insights.

The Challenges Every Trading Business Faces

If you’re in trading, you’re likely dealing with:

I) Lack of Visibility into Product-Wise and Regional Sales Performance

Without proper reporting, it’s hard to know which products or regions are driving revenue.

II) Missed Cross-Selling Opportunities

Businesses often fail to identify buying patterns that could help them recommend related products.

III) Inability to Track Salesperson Performance Accurately

Sales teams may focus on easy-to-sell products instead of pushing strategic ones.

IV) Fluctuating Purchase Rates & Vendor Pricing Variance

Price inconsistencies across vendors for the same item go unnoticed, impacting profit margins.

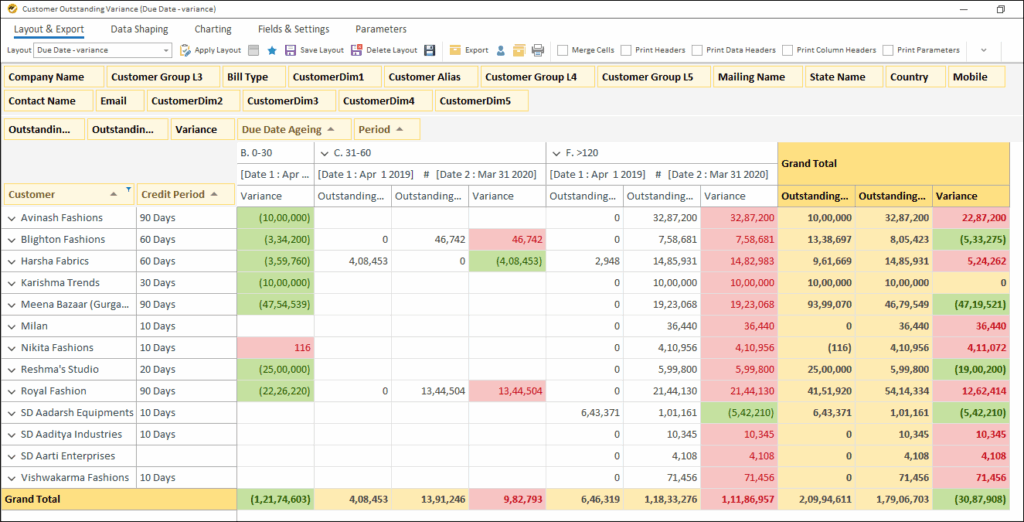

V) Poor Credit Control and Customer Payment Tracking

Delayed payments and increased credit days hurt cash flow and financial planning.

VI) Excess or Non-Moving Inventory

Overstocking of unsold items ties up working capital and increases storage costs.

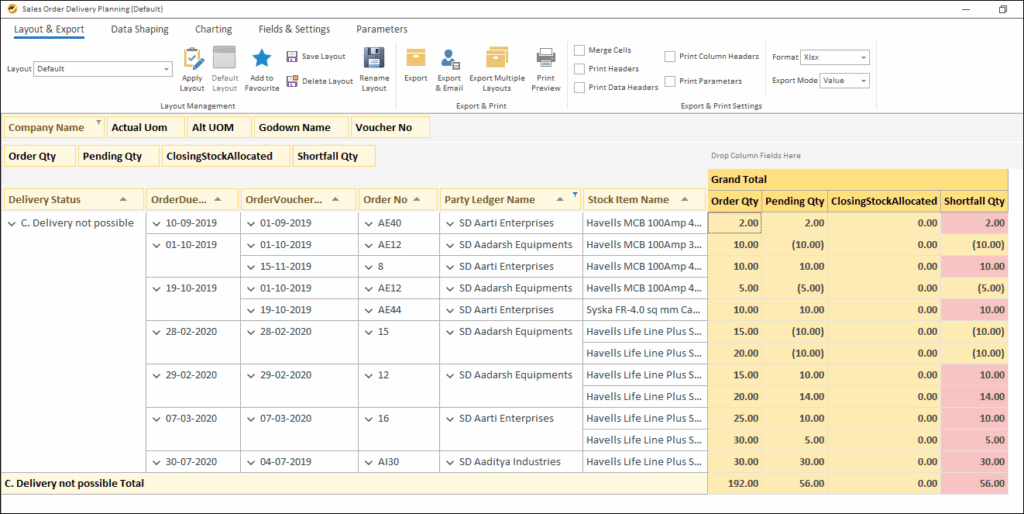

VII) Delayed Order Fulfilment Due to Poor Tracking

Lack of visibility into pending orders leads to delays in deliveries and lost business.

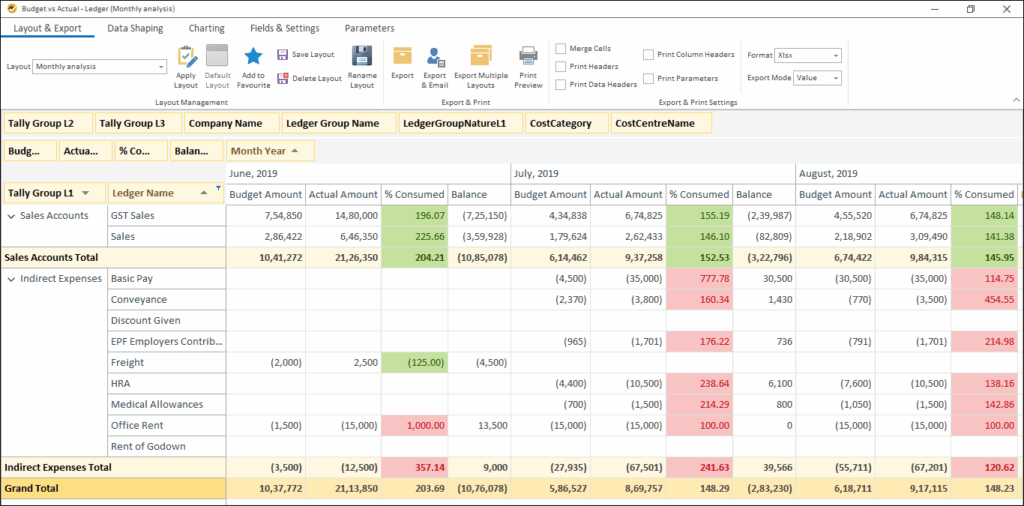

VIII) Manual Expense and Budget Tracking

Without real-time tracking, expenses often exceed budgets, and financial control weakens.

IX) Missed Payments and Reconciliation Errors

Upcoming payments are missed and manual ledger reconciliations lead to compliance risks.

Handling all of this manually or with basic reports slows you down and hides key insights, this is precisely why a reporting tool for trading businesses is essential.

How a Reporting Tool like EasyReports Solves These Problems

Here’s how EasyReports helps trading businesses work smarter:

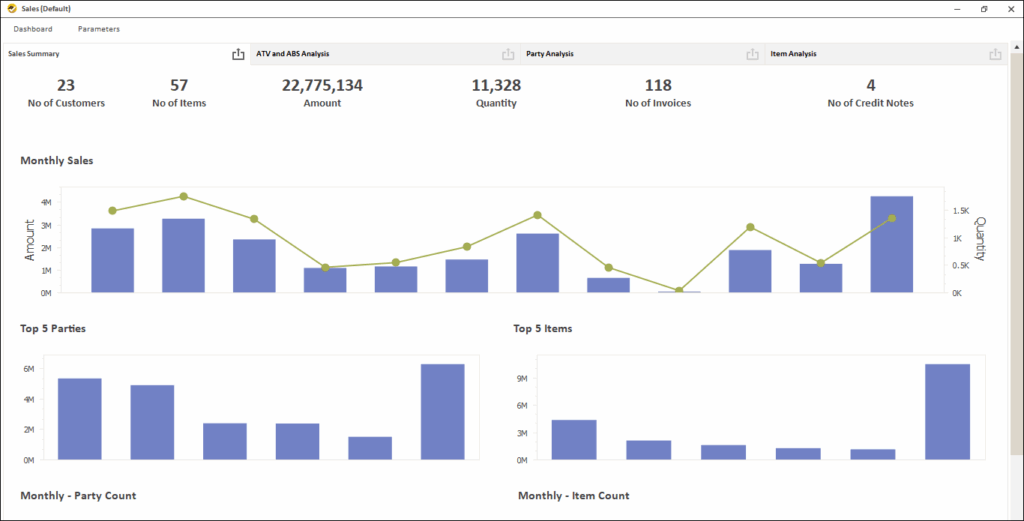

When It Comes to Sales:

- Losing customers: Identify inactive or declining customers to take timely retention actions.

- Recovery from lost customers: Track lost customers and monitor re-engagement efforts to regain them.

- Cross selling products: Analyse customer purchase patterns to suggest complementary products.

- Identifying Focused products – category, company level: Discover top-performing products across company or category levels using custom reports.

- Identifying Focused products – Region or Area level: Segment product performance by region or area to sharpen sales strategy.

- Salesperson product biasness: Uncover if sales persons are over-focusing on specific products, missing growth opportunities.

- Target achievement tracking: Monitor sales targets vs. actuals by product, region or salesperson wise.

For Purchase

- Tracking purchase rate variation of item: Spot fluctuations in item purchase rates to negotiate better deals.

- Vendor wise rate variance of same item: Compare item prices across vendors to identify cost-saving opportunities.

In Customer Management:

- Billing Efficiency – Track new customer added, Average Ticket size etc.: Measure billing trends to assess customer growth and value.

- Customer with increasing / decreasing credit days: Monitor shifts in customer credit periods for better receivables planning.

- Customer credit performance: Analyse customer payment behaviour to assess risk and manage credit limits.

For Inventory

- Stock Clearance – Who can buy: Identify customers who previously purchased non-moving stock for clearance opportunities.

- How much to order: Use sales and stock data to forecast optimal reorder quantities.

- Track non-moving items: Generate reports to flag slow-moving or obsolete inventory for timely action.

For Order Processing

- Planning delivery of pending sales order: Track pending sales orders to prioritize delivery schedules.

- Tracking outstanding purchase order: Monitor open purchase orders to manage supply chain timelines.

In Financial Operations:

- Budget vs actual tracking: Compare planned vs. actual spend to control costs and ensure budget compliance.

- Upcoming payments and receipts: Get visibility into future payables and receivables to manage cash flow.

- Expense analysis: Drill into expense categories for better cost management and insights.

- Columnar ledger: TDS, Expense, GST for reconciliation: Use columnar reports to simplify tax and financial reconciliations.

Now you understand the vital role a reporting tool for trading businesses plays in gaining real-time insights and boosting efficiency. With EasyReports, you don’t just manage your business, you take control, gain clarity & unlock the confidence to grow fearlessly. Book your demo today!

Visit our website for more www.easyreports.in