October 29, 2024

In today’s fast-paced business environment, reliable financial reporting is essential for success. With the combination of Tally and MIS tools like EasyReports, businesses can streamline financial data, boost accuracy and drive strategies for financial reporting. Here’s a closer look at the top 5 strategies for Financial Reporting in Tally and MIS tool.

What is EasyReports?

EasyReports is a reporting and MIS automation tool for Tally, SAP B1, NAV, BC and other ERPs. It enhances your reporting capabilities & offers various standard and customizable reports around different areas of your business.

Let’s dive into the financial reporting strategies:

1. Automate Data Collection and Reconciliation: Reduce Errors and Save Time

Why It Matters: Manual data entry is time-consuming and error prone. For many businesses, data errors are a top concern.

How EasyReports Helps: EasyReports automates data entry and reconciliation, helping businesses eliminate manual errors. The software seamlessly pulls financial data from Tally.ERP9 and Tally Prime – like sales, inventory and accounts payable – into one central repository.

Pro Tip: Leverage EasyReports automated workflows to set up recurring data collection tasks, so your financial reports are always based on the latest numbers.

2. Leverage Real-Time Dashboards and Analytics: Stay on Top of Your KPIs

Why It Matters: Real-time data is crucial for proactive decision-making, especially when financial performance indicators are on the line.

How EasyReports Helps: Specifically, with EasyReports, real-time dashboards keep you constantly updated on KPIs, from cash flow and revenue to expenses and profit margins.

Pro Tip: Additionally, Customize dashboards to display specific metrics for a tailored, data-rich overview.

3. Ensure Compliance and Standardize Reporting Formats: Stay Audit-Ready

Why It Matters: Compliance with financial standards, like GAAP or IFRS, is non-negotiable, especially when it comes to audits and regulatory reporting.

How EasyReports Helps: Generally, EasyReports comes with pre-built reporting templates that align with reporting standards, allowing businesses to stay compliant effortlessly.

Pro Tip: Furthermore, Use EasyReports customizable reporting features to add any specific fields or details required by your industry, helping you stay on top of compliance without sacrificing efficiency.

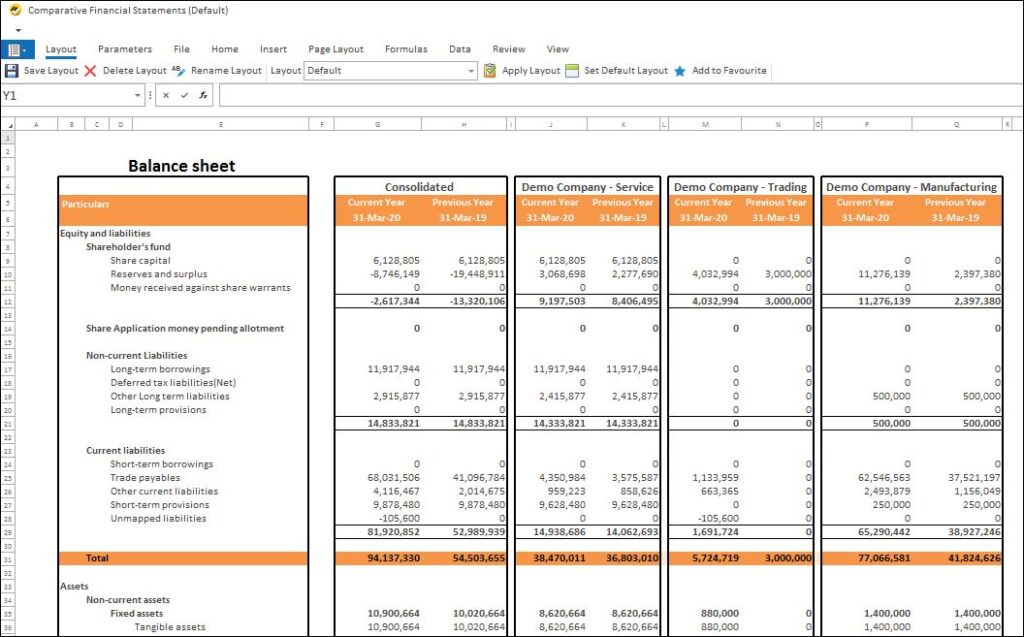

4. Implement Consolidated Reporting for Multi-Entity Structures: Get a Unified Financial Picture

Why It Matters: For businesses with multiple branches or subsidiaries, consolidating financial data is essential.

How EasyReports Helps: EasyReports offers multi-location and multi-entity management capabilities. Which allows you to consolidate data across all branches or entities. In addition, with a few clicks, EasyReports generates comprehensive financial reports that unify financial information, eliminating the need for complex manual adjustments.

Pro Tip: Additionally, Use EasyReports consolidated reporting features to track each location’s performance. To gain insight into the organization’s financial standing.

5. Enhance Data Security and Access Controls: Protect Financial Integrity

Why It Matters: Financial data is sensitive and controlling access is crucial to maintaining its integrity.

How EasyReports Helps: EasyReports offers robust access controls that allow businesses to assign user roles and permissions. This feature ensures that only authorized personnel can view or edit financial reports.

Pro Tip: Furthermore, regularly review user access settings to adapt to changes in team roles. Ensuring only the right people have access to sensitive financial data.

Wrapping Up

These are top 5 strategies for financial reporting in Tally & MIS tool. Financial reporting doesn’t have to be a challenging or manual task. MIS tools like EasyReports simplifies the process by automating workflows, providing real-time insights, ensuring compliance, consolidating data across entities and enhancing security.

Ready to optimize your financial reporting process with Tally ERP and EasyReports? Get your demo now!

Disclaimer: This blog article is for educational purposes only. Tally is a product of Tally Solutions Pvt. Ltd. and we do not claim any affiliation.