November 11, 2019

GSTR-1 is a quarterly or monthly return that should be filed by every registered GST dealer. It consists of details of all outward supplies i.e sales. Every GST registered person is required to file GSTR-1 irrespective of whether there had been any transactions during that particular month or not. In this blog, we will explore how you can generate GSTR – 1 report.

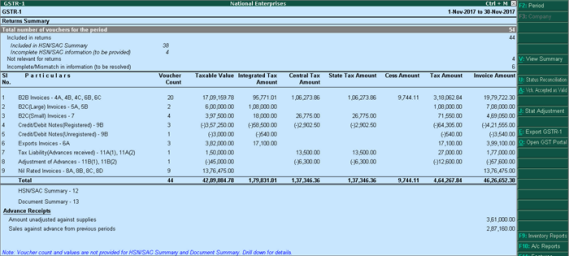

GSTR-1 report includes the details of all outward supplies of B2B invoices, B2C invoices, adjustments to sales made in debit or credit notes, exports, nil rated invoices, advances received with tax adjustments.

Users need to file GSTR-1 returns:

- Every month, for aggregate turnover exceeding Rs. 1.5 crores.

- Every quarter, for aggregate turnover up to Rs. 1.5 crores.

In order to view the report in the format provided by GST:

1) Go to Gateway of Tally

2) Click on Display

3) Click on Statutory Reports

4) Click on GST

5) Select GSTR-1

6) Users can press Alt +V in GSTR-1 report to change the view from return format to summary view and vice versa.

7) Specify the required reporting period by pressing F2.

8) User can generate the report with the line HSN or SAC Summary by enabling the option Show HSN or SAC Summary?

9) User can generate the HSN or SAC Summary report with only the description or HSN or both, based on the grouping set in the option Group vouchers by .

10) If HSN or SAC description is not specified in the masters, you can set Use stock item or ledger name as HSN or SAC description when not specified? to Yes . The stock item or ledger name will appear as the HSN or SAC description.

Filing GSTR-1 is a crucial compliance requirement for every GST-registered business, whether monthly or quarterly, depending on turnover. With Tally.ERP 9, generating and managing GSTR-1 reports becomes a seamless process. From viewing outward supply details to generating HSN/SAC summaries, Tally simplifies the entire workflow. Also, ensuring accuracy and adherence to GST regulations.

These are the above steps how you can generate GSTR – 1 report. By following the steps outlined in this guide, businesses can efficiently file their GSTR-1 returns. As well as avoid penalties and maintain smooth GST compliance. Stay organized, stay compliant, and let Tally.ERP 9 handle the complexities of GST reporting for you.